UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Assured Guaranty Ltd.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-1

DEAR SHAREHOLDERS:

It is with great pleasure that we invite you to our 20232024 Annual General Meeting of shareholders on Thursday, May 2, 2024, at 8:009:30 a.m. on Wednesday, May 3, 2023,London time, at 6 Bevis Marks, in London.London, EC3A 7BA. Whether or not you plan to attend the meeting, please vote your shares; your vote is important to us.

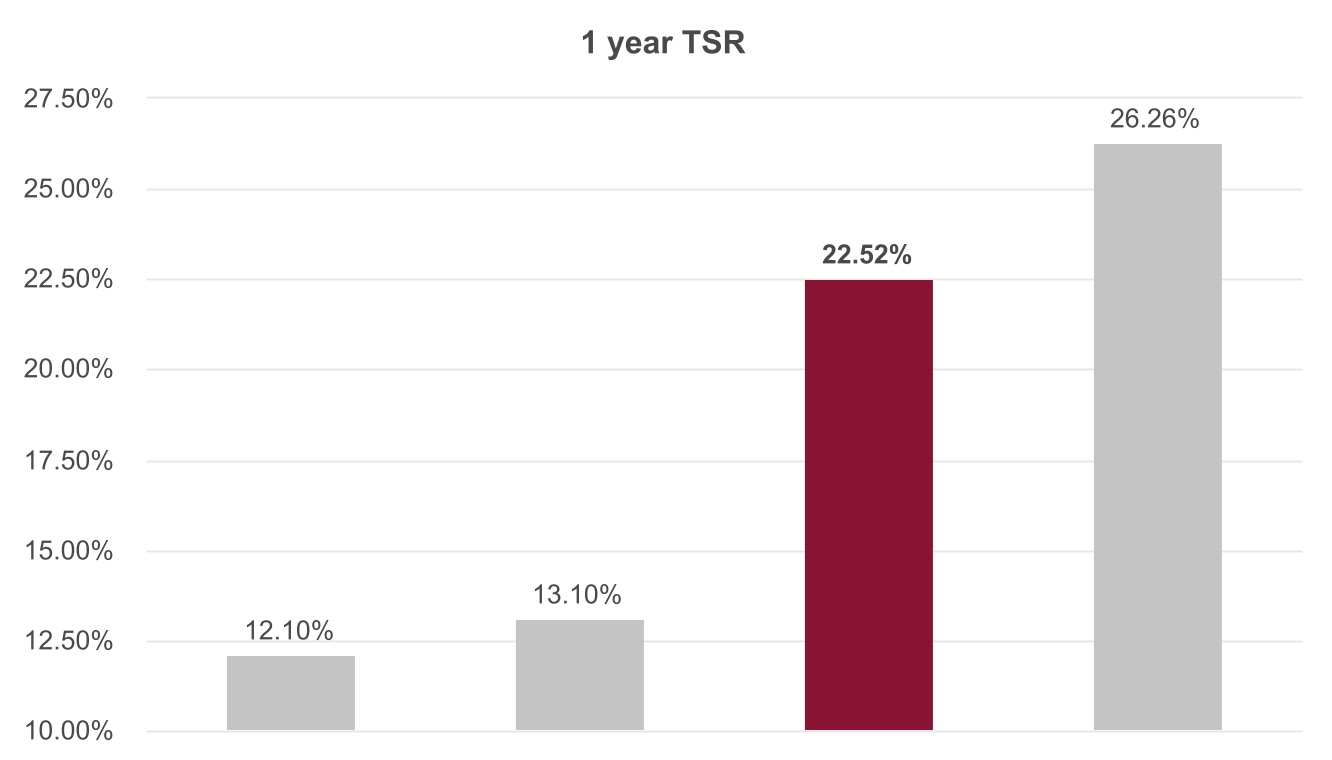

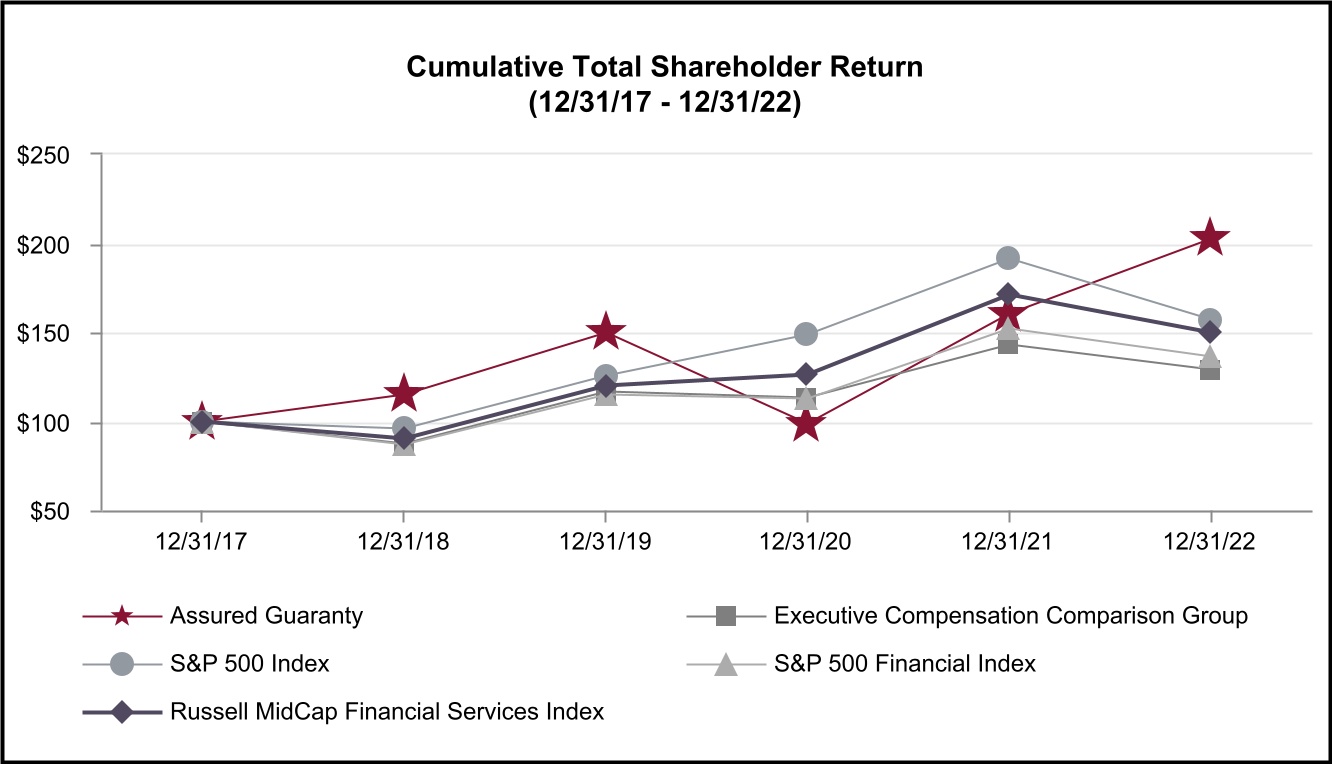

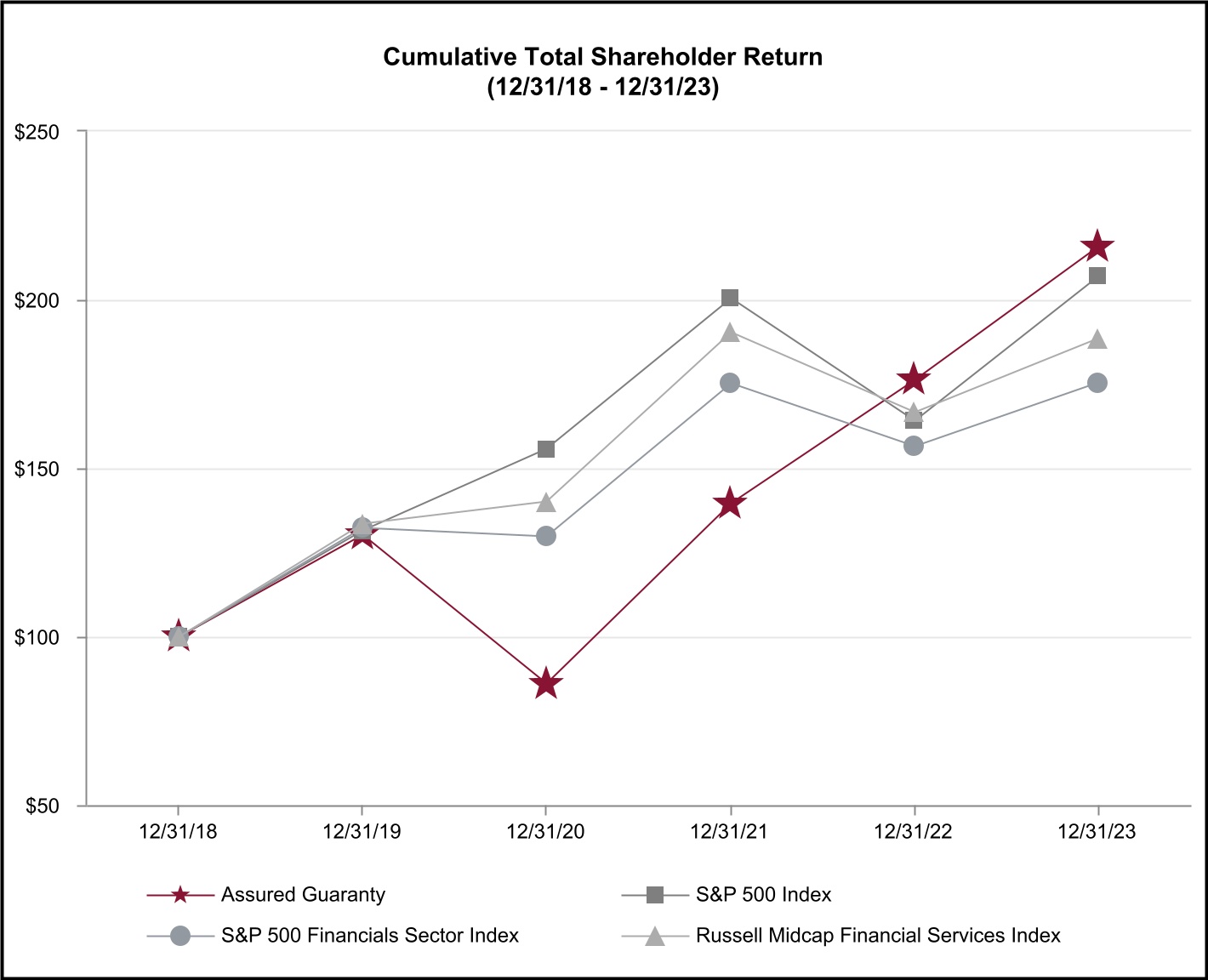

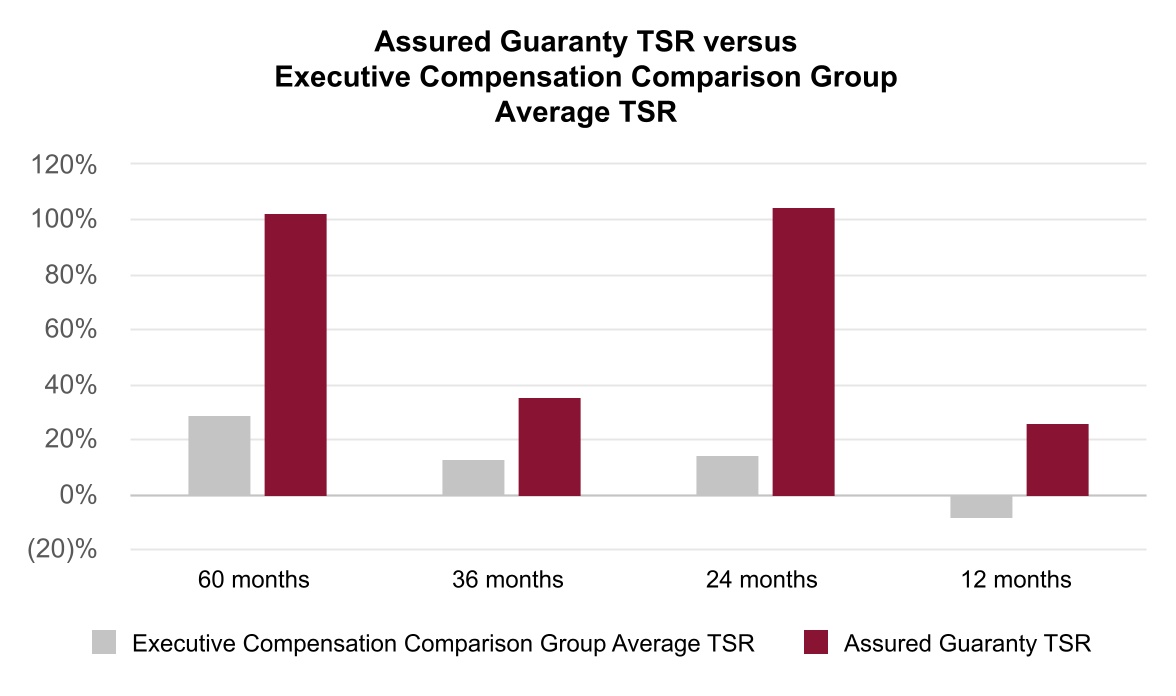

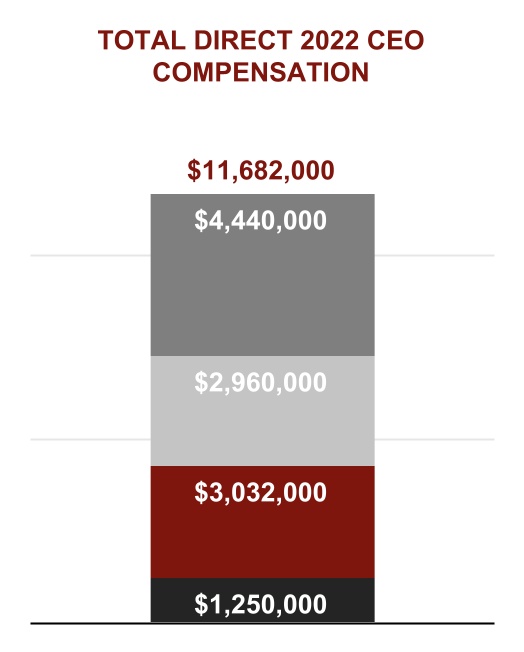

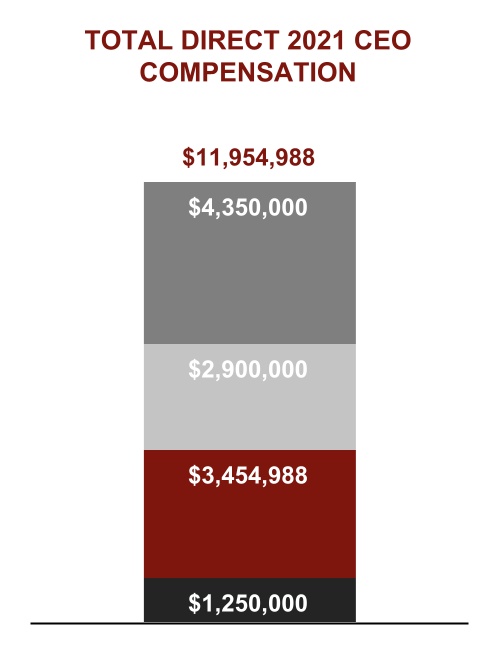

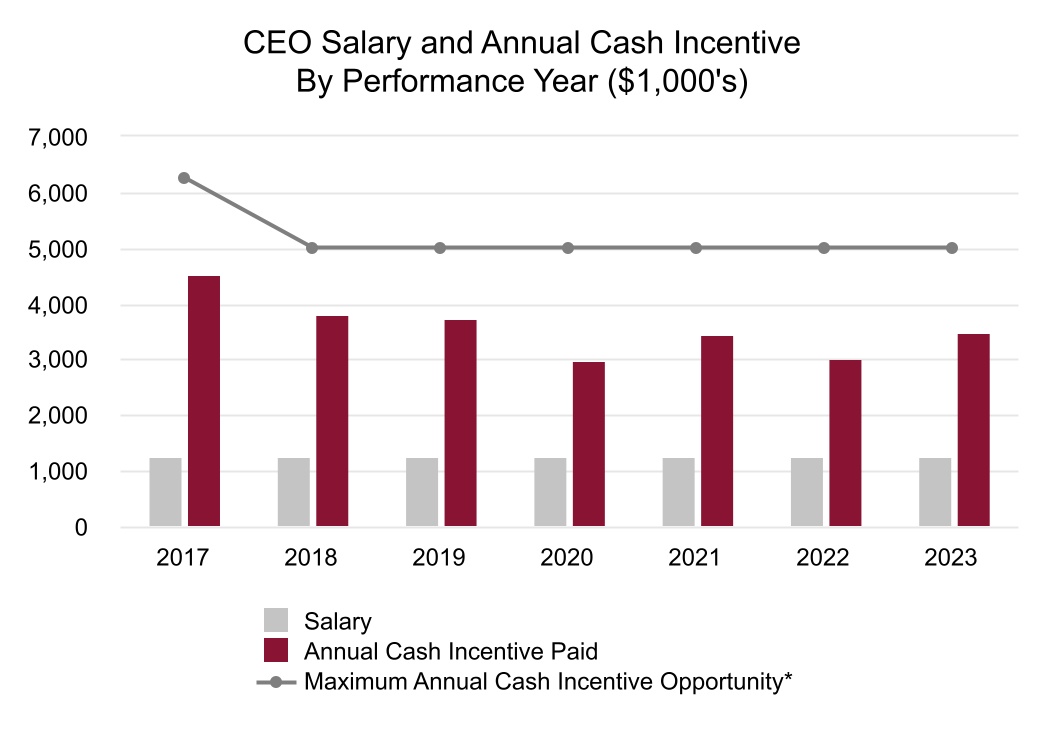

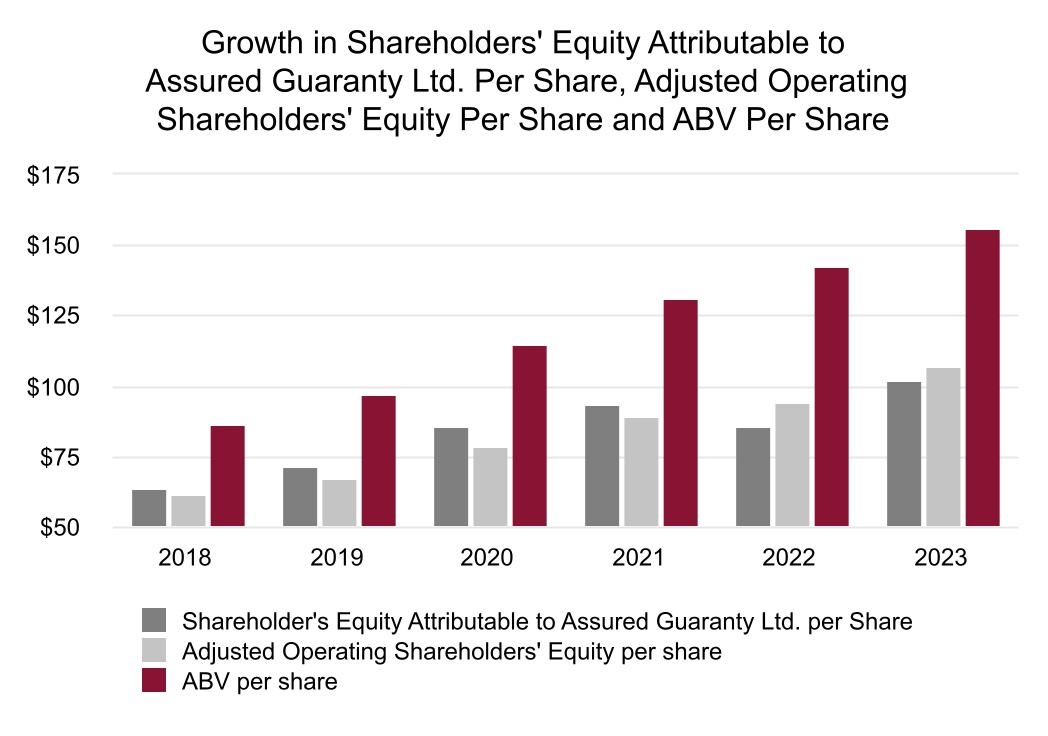

DuringWe had an excellent year in 2023. Our U.S. GAAP net income attributable to Assured Guaranty Ltd. per share was more than six times that of 2022 weand our adjusted operating income per share* was more than two and one-half times that of 2022, in each case rising to the highest levels in our Company's history, reflecting the cumulative effect of our long-standing strategic initiatives across all aspects of our business. We continued to build shareholder value, growing our shareholders' equity attributable to Assured Guaranty Ltd. per share, adjusted operating shareholders’ equity*equity per shareshare*, and adjusted book value*value per shareshare* to new highs of $93.92$101.63, $106.54, and $141.98,$155.92, respectively. Our share price responded, risingrose over 24%20% from $50.20 at the end of 2021 to $62.26 at the end of 2022.2022 to $74.83 at the end of 2023. Our total shareholder return for the year, which we refer to as TSR**, at over 22%, was over 26%, whilenearly double the one-year TSR forof the S&P 500 Index, the S&P Financial ServicesFinancials Sector Index and the Russell Mid-CapMidcap Financial Services Index were all negative. This is not a fluke — our five-year TSR from the end of 2017 to the end of 2022 was over 102%, while the TSR of those indices ranged between 36% and 57%.Index.

Perhaps ourOur most significant accomplishment in 20222023 was settlingtransforming our asset management strategy by contributing substantially all our defaulted insured Puerto Rico exposures but one (the Puerto Rico Electric Power Authority), which when combined with normal amortization, reduced our par exposure that we rate below investment grade to 2.5% of our insured portfolio, belowasset management business to Sound Point Capital Management, LP, which we refer to as Sound Point, for an approximately 30% interest in the 3% targetcombined entity. By executing the strategy envisioned by our Chief Executive officer, who we refer to as our CEO, and adopted by our Board of Directors, who we refer to as our Board, of substantially increasing the scale of the asset management business in which we participate, this transaction significantly advances the strategic goals our CEO envisioned and our Board set well overfor our participation in the asset management business: (1) to further diversify our earnings and participate in a decade agofee-based earnings stream independent of the risk-based premiums generated by our financial guaranty business, and (2) to improve our investment returns by increasing our allocation to alternative investments in our investment portfolio. The transaction is an important milestone in our pursuit of our vision of establishing a meaningful presence in the lowest sinceasset management business and positions us for further growth in the asset management segment in the future. The transaction (along with the separate sale of the remainder of our acquisitionasset management business) also resulted in a $222 million pre-tax gain, net of Financial Security Assuranceexpenses, in 2009.2023, a recognition of the improvements we made consistent with our CEO's strategic direction after purchasing BlueMountain Capital Management, LLC and related entities, which we refer to as BlueMountain, when we entered the business in 2019.

We are proud that, despite new issuance volume in U.S. public finance, the headwinds of a volatile fixed-incomeprimary market trying to absorb a sudden increase in interest rates,for our insurance product, remaining relatively low, we still achieved new business production in the insurance segment, a non-GAAP financial measure we refer to as PVP*, of $375over $400 million exceeding lastfor only the second time since 2009 (excluding the PVP impact of our 2018 Syncora Guarantee Inc. reinsurance transaction), due in large part to our strategic decision fifteen years ago, championed by our CEO, to also pursue financial guaranty business in markets other than the U.S. public finance market, while our only monoline financial guaranty competitor chose

to limit itself to the U.S. public finance market. Our total PVP of $404 million for 2023 was nearly 8% over the previous year’s total. In the primary market for our insurance product, U.S. municipalpublic finance, we produced total PVPinsured 5.4% of $257 million, also exceeding last year's total.all new municipal bond issues by par, our highest penetration rate since 2011, when we had no other active financial guarantor competitors. During the year, we guaranteed 31insured 37 U.S. municipal transactions that each utilized overwith more than $100 million of our insurance, including four where we insured more than $500 million,par (a nearly 20% increase over last year), which we believe is a good barometer of demand for our product in the institutional market. In what we believe is another good sign of demand for our product, we insured $3.3 billion in gross par in U.S. public finance secondary market transactions, a growth of 650% over the $437 million we insured in that market in the prior year. Our other insurance areas, non-U.S. public finance and global structured finance,We also achieved excellent results, producing $68 million and $50produced $109 million of PVP respectively, during the year. The $50 million of PVP produced in global structured finance was the second highest ininsurance, a decade.

In our asset management business, we ended 2022 with $17.5 billion of assets under management, which we refer to as AUM, essentially flat to 2021. We raised $1.4 billion of third-party AUM, despite a challenging global economy and financial markets,nearly 118% increase over last year, and the noticeable wideninghighest PVP from that group since 2008. Finally, we produced $83 million of spreadsPVP in the collateralized loan obligation market.

We continued ourthe successful capital management program we initiated eleven years ago based on our CEO's strategic vision by returning $567$267 million to our shareholders through share repurchases and dividends. During 2022,2023, we repurchased nearly 93.2 million of our shares, reducingsignificantly contributing to the overall reduction of our share count from the end of 20212022 by 13%4.7%. We issued $350 million of 5-year senior unsecured debt with a coupon of 6.125%, the proceeds of which we used in large part to redeem $330 million of 10-year debt due July 1, 2024, reducing our refinance risk in 2024 and allowing us to continue our share repurchase program in 2023 rather than accumulating cash for the July 2024 debt maturity.

We have also made stridestake great pride in environmental and social responsibility areas. Guided by our employee-led Diversity and Inclusion Committee and Corporate Philanthropy Committee, we introduced several new initiatives while expanding and enhancing management's commitment to support our employees and communities. We could not be prouder of all that our employees accomplished in 2022.2023 accomplishments.

Sincerely,

| | | | | | | | |

| | |

| Francisco L. Borges | | Dominic J. Frederico |

| Chair of the Board | | President and Chief Executive Officer |

* Adjusted operating shareholder’s equity per share, adjusted book value per share, adjusted operating income and PVP are non-GAAP financial measures. An explanation of these measures, which are considered when setting executive compensation, and a reconciliation to the most comparable U.S. GAAP measures, may be found on pages 101 and 10395 to 10799 of our Annual Report on Form 10-K for the year ended December 31, 2022.2023. In addition, please refer to the section entitled “Forward Looking Statements” following the cover of that Annual Report on Form 10-K. ** Point-to-point measurement based on end-of-year share prices and including the impact of dividends.

| | | | | |

| Assured Guaranty Ltd. 30 Woodbourne Avenue Hamilton HM 08, Bermuda |

NOTICE OF ANNUAL GENERAL MEETING

TO THE SHAREHOLDERS OF ASSURED GUARANTY LTD.:

The Annual General Meeting of Assured Guaranty Ltd., which we refer to as AGL, will be held on Wednesday,Thursday, May 3, 2023,2, 2024, at 8:009:30 a.m. London Time,time, at 6 Bevis Marks, London, EC3A 7BA, United Kingdom. The Annual General Meeting is being held for the following purposes:

1.Elect our board of directors;

2. Approve, on an advisory basis, the compensation paid to AGL’s named executive officers;

3. Approve on an advisory basis, the frequency of the advisory vote on compensation paid to AGL's named executive officers;Assured Guaranty Ltd. 2024 Long-Term Incentive Plan;

4. Approve the AGL Employee Stock Purchase Plan, as amended through the Fourth Amendment;

5. Appoint PricewaterhouseCoopers LLP as AGL’s independent auditor for the fiscal year ending December 31, 2023,2024, and authorize the Board of Directors, acting through its Audit Committee, to set the fees for the independent auditor;

6.5. Direct AGL to vote for directors of, and the appointment of the independent auditor for, its subsidiary Assured Guaranty Re Ltd.; and

7.6. Transact such other business, if any, as lawfully may be brought before the meeting.

Shareholders of record are being mailed a Notice Regarding the Availability of Proxy Materials on or around March 22, 2023,20, 2024, which provides them with instructions on how to access the proxy materials and our 20222023 annual report on the internet, and if they prefer, how to request paper copies of these materials.

In the event we postpone or change the date, time or location of our Annual General Meeting, as a result of governmental travel or gathering restrictions related to pandemics or otherwise, we will post the revised meeting information on our website at www.assuredguaranty.com/annualmeeting as soon as possible after changing the date, time and place for the postponed meeting. We will also promptly issue a press release that we will make available on our website at www.assuredguaranty.com/annualmeeting and file with the Securities and Exchange Commission (which we refer to as the SEC) as definitive additional proxy material. Therefore, prior to and on the date of the Annual General Meeting, please visit our website or the SEC’s website (www.sec.gov) to determine if there has been any change to the date, time or location of our Annual General Meeting. If you wish to receive a physical copy of any such press release, please contact our Secretary at generalcounsel@agltd.com or (441) 279-5725.

Only shareholders of record at the close of business on March 10, 2023,8, 2024, as shown by the transfer books of AGL, are entitled to notice of, and to vote at, the Annual General Meeting.

REGISTERED SHAREHOLDERS WHO HOLD OUR SHARES DIRECTLY MAY VOTE UP UNTIL 12:00 NOON EASTERN DAYLIGHT TIME ON MAY 2, 2023.1, 2024. BENEFICIAL SHAREHOLDERS MUST SUBMIT THEIR VOTING INSTRUCTIONS SO THAT THEIR BROKERS WILL BE ABLE TO VOTE BY 11:59 P.M. EASTERN DAYLIGHT TIME ON MAY 1, 2023.APRIL 30, 2024. EMPLOYEE SHAREHOLDERS WHO PARTICIPATE IN THE ASSURED GUARANTY LTD. EMPLOYEE STOCK PURCHASE PLAN MAY VOTE UP UNTIL 11:59 P.M. EASTERN DAYLIGHT SAVINGS TIME ON APRIL 28, 2023.29, 2024.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL GENERAL MEETING IN PERSON OR BY PROXY, AND REGARDLESS OF THE NUMBER OF SHARES YOU OWN, PLEASE VOTE AS PROMPTLY AS POSSIBLE VIA THE INTERNET OR BY TELEPHONE. ALTERNATIVELY, IF YOU HAVE REQUESTED WRITTEN PROXY MATERIALS, PLEASE SIGN, DATE AND RETURN THE PROXY CARD IN THE RETURN ENVELOPE PROVIDED AS PROMPTLY AS POSSIBLE. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. FOR FURTHER INFORMATION CONCERNING THE INDIVIDUALS NOMINATED AS DIRECTORS, THE PROPOSALS BEING VOTED UPON, USE OF THE PROXY AND OTHER RELATED MATTERS, YOU ARE URGED TO READ THE ATTACHED PROXY STATEMENT.

By Order of the Board of Directors,

Ling Chow

Secretary

TABLE OF CONTENTS

| | | | | |

| 1 |

| 4 |

| Overview ______________________________ | 4 |

| How Are Directors Nominated? _____________ | 5 |

| Committees of the Board _________________ | 6 |

| 8 |

| Director Compensation ___________________ | 9 |

| 11 |

| 11 |

| Board Oversight of Cybersecurity___________ | 12 |

Compensation Committee Interlocking and Insider Participation ____________________ | 12 |

| What Is Our Related Person Transactions Approval Policy and What Procedures Do We Use To Implement It? ________________ | 12 |

What Related Person Transactions Do We Have? ______________________________ | 1213 |

| 14 |

| 17 |

| 19 |

How Much Stock IsMany Common Shares Are Owned By Directors, Nominees and Executive Officers? _____________________________________ | 19 |

Which Shareholders Own More Than 5% of Our Common Shares? __________________ | 20 |

ELECTION OF DIRECTORS _____________ | 21 |

| 30 |

| 3329 |

| Compensation Discussion and Analysis ______ | 3329 |

| CD&A Roadmap _______________________ | 3329 |

| Summary _____________________________ | 3430 |

| Executive Compensation Program Structure and Process _________________________ | 3937 |

| CEO Performance Review _______________ | 5149 |

Other Named Executive Officer Compensation Decisions ________________ | 59 |

20222023 Executive Compensation Conclusion ___ | 6162 |

| Compensation Governance ______________ | 6263 |

| Post-Employment Compensation __________ | 6667 |

| Tax Treatment _________________________ | 6668 |

Non-GAAP FinancialsFinancial Measures _______________________ | 6768 |

| Compensation Committee Report ___________ | 6870 |

| Summary Compensation Table _____________ | 6971 |

| Employment Agreements _________________ | 7072 |

| Perquisite Policy ________________________ | 7072 |

| Severance Policy _______________________ | 7072 |

| | | | | |

| Employee Stock Purchase Plan ____________ | 7072 |

| Indemnification Agreements _______________ | 7072 |

| | | | | |

20222023 Grants of Plan-Based Awards _________ | 7173 |

| Outstanding Equity Awards ________________ | 7375 |

2022 Stock2023 Shares Vested ___________________________________________ | 7476 |

| Non-Qualified Deferred Compensation _______ | 7577 |

| Potential Payments Upon Termination or Change in Control ______________________ | 7577 |

| Non-Qualified Retirement Plans ____________ | 7779 |

| Incentive Plans _________________________ | 7779 |

| CEO Pay Ratio _________________________ | 7880 |

| Pay Versus Performance__________________ | 7880 |

| 8284 |

ADVISORY APPROVAL OF EXECUTIVE COMPENSATION ______________________ | 8385 |

ADVISORY VOTE ON THE FREQUENCYAPPROVAL OF THE ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS____________________________ASSURED GUARANTY LTD. 2024 LONG-TERM INCENTIVE PLAN__

| 8486 |

APPROVAL OF EMPLOYEE STOCK PURCHASE PLAN AS AMENDED__________

| 85 |

APPOINTMENT OF INDEPENDENT AUDITOR _____________________________ | 8994 |

| Assessment of Independent Auditor_________ | 94 |

| Independent Auditor Fee Information ________ | 8995 |

Pre-Approval Policy of Audit and Non-Audit Services ______________________________ | 9095 |

| Audit Committee Report___________________ | 96 |

PROPOSALS CONCERNING OUR SUBSIDIARY, ASSURED GUARANTY RE LTD. ______________________________ | 9198 |

Proposal 6.1-Election5.1 - Election of AG Re Directors _________ | 9198 |

Proposal 6.2-Appointment5.2 - Appointment of AG Re Auditor _____ | 93100 |

| 94101 |

How do I submit a proposal for inclusion in next year’s proxy material? _______________ | 94101 |

| How do I submit a proposal or make a nomination at an Annual General Meeting? __ | 94101 |

INFORMATION ABOUT THE ANNUAL GENERAL MEETING AND VOTING _______ | 95102 |

| 101107 |

EXHIBIT A: EMPLOYEE STOCK PURCHASEASSURED GUARANTY LTD. 2024 LONG-TERM INCENTIVE PLAN AS AMENDED THROUGH THE FOURTH AMENDMENT______ | 102108 |

PROXY STATEMENT SUMMARY

| | | | | | | | |

| Assured Guaranty Ltd. | | March 22, 202320, 2024 |

This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider before voting. For more complete information about the following topics, please review the complete proxy statement and the Annual Report on Form 10-K of Assured Guaranty Ltd. (which we refer to as AGL, we, us or our; we use Assured Guaranty, our Company or the Company to refer to AGL together with its subsidiaries).

We intend to begin distribution of the Notice Regarding the Availability of Proxy Materials to shareholders on or about March 22, 2023.20, 2024.

ANNUAL GENERAL MEETING OF SHAREHOLDERS

| | | | | | | | |

| Time and Date | | 8:009:30 a.m. London time, May 3, 20232, 2024 |

| | |

| Place | | 6 Bevis Marks London, EC3A 7BA United Kingdom |

| | |

| Record Date | | March 10, 20238, 2024 |

| | |

| Voting | | Shareholders as of the record date are entitled to vote. Each Common Share is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. Registered shareholders who hold our shares directly may vote up until 12:00 Noon Eastern Daylight Savings Time on May 2, 2023.1, 2024. Beneficial owners must submit their voting instructions so that their brokers will be able to vote by 11:59 p.m. Eastern Daylight Savings Time on May 1, 2023.April 30, 2024. Employee shareholders who participate in the Assured Guaranty Ltd. Employee Stock Purchase Plan may vote up until 11:59 p.m. Eastern Daylight Savings Time on April 28, 2023.29, 2024. In spite of those deadlines, holders who attend the Annual General Meeting will be able to vote in person. |

VOTING MATTERS

| | | | | | | | |

| Agenda Item | Board Vote Recommendation | Page Reference (for More Detail) |

| Election of directors | For each director nominee | Page 21 |

| Approval, on an advisory basis, of the compensation paid to AGL’s named executive officers | For | Page 83 |

Approval, on an advisory basis, of the frequency of the advisory vote on compensation paid to AGL's named executive officers | For a frequency of one year | Page 8485 |

Approval of the AGL Employee Stock PurchaseAssured Guaranty Ltd. 2024 Long-Term Incentive Plan as amended through the Fourth Amendment | For | Page 8586 |

Appointment of PricewaterhouseCoopers as AGL’s independent auditor for 20232024 and authorization of the Board of Directors, acting through its Audit Committee, to set the fees for the independent auditor | For | Page 8994 |

| Direction of AGL to vote for directors of, and the appointment of the independent auditor of, AGL’s subsidiary, Assured Guaranty Re Ltd. | For each director nominee and for the independent auditor | Page 9198 |

We will also transact any other business that may properly come before the meeting.

1 Assured Guaranty 20232024 Proxy Statement

If we postpone or change the date, time or location of our Annual General Meeting, as a result of travel or gathering restrictions related to the pandemic or otherwise, we will post the revisednew meeting information on our website at www.assuredguaranty.com/annualmeeting as soon as possible after changing the date, time and place for the postponed meeting.possible. We will also promptly issue a press release that we will make available on our website at www.assuredguaranty.com/annualmeeting and file with the SEC as definitive additional proxy material. Therefore, prior to and on the date of the Annual General Meeting, please visit our website or the SEC’s website (www.sec.gov) to determine if there has been any change to the date, time or location of our Annual General Meeting. If you wish to receive a physical copy of any such press release, please contact our Secretary at generalcounsel@agltd.com or (441) 279-5725.

This proxy statement makes a number of references to our website. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this proxy statement.

Assured Guaranty 20232024 Proxy Statement 2

SUMMARY DIRECTOR INFORMATION

The following table provides summary information about each director nominee, including their current committee assignments. Each director nominee will be elected for a one-year term by a majority of votes cast. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOMINEE | | DIRECTOR SINCE | PRINCIPAL OCCUPATION | COMMITTEES |

| A | C | ES | F | NG | RO | E |

| Francisco L. Borges | 71 | 2007 | Partner of Ares Management Corporation and Co-Head of Ares Secondary Solutions | | | | | | | |

| G. Lawrence

Buhl | 76 | 2004 | Former Regional Director for Insurance Services, Ernst & Young LLP | ü | ü |

| | ü | | |

| Dominic J. Frederico | 70 | 2004 | President and Chief Executive

Officer, Assured Guaranty Ltd. | | | | | | | ü |

| Bonnie L. Howard | 69 | 2012 | Former Chief Auditor and Global Head of Control and Emerging Risk, Citigroup | | ü | | | ü | | |

| Thomas W. Jones | 73 | 2015 | Founder and Senior Partner of TWJ Capital, LLC | ü | | | | ü | | |

| Patrick W. Kenny | 80 | 2004 | Former President and Chief

Executive Officer, International Insurance Society | | ü | ü | | ü | | ü |

| Alan J. Kreczko | 71 | 2015 | Former Executive Vice President

and General Counsel of The

Hartford Financial Services

Group, Inc. | | | | ü | ü | | |

| Simon W. Leathes | 75 | 2013 | Former Independent

non-executive director of

HSBC Bank plc | | | ü | ü | | | ü |

| Yukiko Omura | 67 | 2014 | Former Executive Vice President and Chief Executive Officer of the

Multilateral Investment Guarantee Agency of the World Bank Group | | | ü | | | ü | |

| Lorin P.T. Radtke | 54 | 2021 | Co-founder and Partner, M Seven 8 | ü | | | ü | | ü | |

| Courtney C. Shea | 62 | 2021 | Former Managing Member, Columbia Capital Management | ü | | | ü | | ü | |

| | | | 2022 Meetings | 4 | 5 | 4 | 4 | 4 | 4 | 0 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOMINEE | | DIRECTOR SINCE | PRINCIPAL OCCUPATION | COMMITTEES |

| A | C | ES | F | NG | RO | E |

| Mark C.

Batten | 67 | 2024 | Former Partner of PricewaterhouseCoopers LLP | ü | | | ü | | ü | |

| Francisco L. Borges | 72 | 2007 | Partner and Chairman of the Ares Secondaries Group | | | | | | | |

| Dominic J. Frederico | 71 | 2004 | President and Chief Executive

Officer, Assured Guaranty Ltd. | | | | | | | ü |

| Bonnie L. Howard | 70 | 2012 | Former Chief Auditor and Global Head of Control and Emerging Risk, Citigroup | | ü | | | ü | | |

| Thomas W. Jones | 74 | 2015 | Founder and Senior Partner of TWJ Capital, LLC | ü | | | | ü | | |

| Alan J. Kreczko | 72 | 2015 | Former Executive Vice President

and General Counsel of The

Hartford Financial Services

Group, Inc. | | | | | ü | ü | |

| Yukiko Omura | 68 | 2014 | Former Executive Vice President and Chief Executive Officer of the

Multilateral Investment Guarantee Agency of the World Bank Group | | ü | ü | | | | ü |

| Lorin P.T. Radtke | 55 | 2021 | Co-founder and Partner, M Seven 8 | | | ü | ü | | | |

| Courtney C. Shea | 63 | 2021 | Former Managing Member, Columbia Capital Management | ü | | | ü | | ü | |

| | | | 2023 Meetings | 4 | 5 | 4 | 4 | 4 | 4 | 0 |

: Chair; ü: Member

A: Audit; C: Compensation; ES: Environmental and Social Responsibility; F: Finance; NG: Nominating and Governance; RO: Risk Oversight; E: Executive.

3 Assured Guaranty 20232024 Proxy Statement

CORPORATE GOVERNANCE

OVERVIEW

THE BOARD OF DIRECTORS

Our Board of Directors maintains strong corporate governance policies.

•Our Board and management have reviewed the rules of the SEC and the New York Stock Exchange (which we refer to as the NYSE) listing standards regarding corporate governance policies and processes, and we are in compliance with the rules and listing standards.

•We have adopted Corporate Governance Guidelines covering issues such as director qualification standards (including independence), director responsibilities, Board self-evaluations, and executive sessions of our Board.

•Our Corporate Governance Guidelines contain our Categorical Standards for Director Independence.

•We have adopted a Global Code of Ethics for our employees and directors and charters for each Board committee.

The full text of our Corporate Governance Guidelines, our Global Code of Ethics and each Board committee charter, are available on our website at www.assuredguaranty.com/governance. In addition, you may request copies of the Corporate Governance Guidelines, the Global Code of Ethics and the committee charters by contacting our Secretary via:

| | | | | | | | |

| Telephone | | (441) 279-5725 |

| Facsimile | | (441) 279-5701 |

| e-mail | | generalcounsel@agltd.com |

MEETINGS OF THE BOARD

Our Board of Directors oversees our business and monitors the performance of management. The directors keep themselves up-to-date on our Company by discussing matters with Mr. Frederico, who is our Chief Executive Officer (and whom we refer to as our CEO),CEO, other key executives and our principal external advisors, such as outside auditors, outside legal counsel, investment bankers and other consultants, by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings.

Our Board usually meets four times per year in regularly scheduled meetings, but will meet more often if necessary. During 2022,2023, our Board met four times. All but one of our directors, Michelle McCloskey,Simon Leathes, attended at least 75% of the aggregate number of meetings of our Board and committees of our Board of which they were a member held while they were in office during the year ended December 31, 2022. Ms. McCloskey2023. Mr. Leathes missed threetwo sets of Board and committee meetings in 2022,2023, due to health issues. Ms. McCloskeyMr. Leathes is retiring from our Board effective upon the election of our directors at our Annual General Meeting of Shareholders on May 3, 2023.2, 2024.

DIRECTOR INDEPENDENCE

In February 2023,2024, our Board determined that, other than Mr. Frederico, all of our directors are independent under the listing standards of the NYSE. These independent directors constitute substantially more than a majority of our Board. In making its determination of independence, our Board applied its Categorical Standards for Director Independence and determined that no other material relationships existed between our Company and these directors.directors (with the Board acknowledging Mr. Batten's service as non-executive chair of AGL's U.K. insurance subsidiary, Assured Guaranty UK Limited, and a member of its remuneration and nomination committee). A copy of our Categorical Standards for Director Independence is available as part of our Corporate Governance Guidelines, which are available on our website at www.assuredguaranty.com/governance. In addition, as part of the independence determination, our Board monitors the independence of Audit and Compensation Committee members under rules of the SEC and NYSE listing standards that are applicable to members of the Audit Committee and Compensation Committee.

As part of its independence determinations, our Board considered the other directorships held by the independent directors and determined that none of these directorships constituted a material relationship with our Company.

DIRECTOR EXECUTIVE SESSIONS

The independent directors meet at regularly scheduled executive sessions without the participation of management. The Chair of our Board is the presiding director for executive sessions of independent directors.

Assured Guaranty 20232024 Proxy Statement 4

OTHER CORPORATE GOVERNANCE HIGHLIGHTS

•Our Board has a substantial majority of independent directors.

•All members of the Audit, Compensation, Nominating and Governance, Finance, Environmental and Social Responsibility, and Risk Oversight Committees are independent directors.

•Our Audit Committee recommends to our Board, which recommends to theour shareholders, the annual appointment of our independent auditor. Each year our shareholders are asked to authorize our Board, acting through its Audit Committee, to determine the compensation of, and the scope of services performed by, our independent auditor. The Audit Committee also has the authority to retain outside advisors.

•No member of our Audit Committee simultaneously serves on the audit committee of more than one other public company.

•Our Compensation Committee has engaged a compensation consultant, Frederic W. Cook & Co., Inc., which we refer to as FW Cook, to assist it in evaluating the compensation of our CEO, based on corporate goals and objectives and, with the other independent directors, setting his compensation based on this evaluation. FW Cook has also assisted us in designing our executive compensation program. Our Compensation Committee has conducted an assessment of FW Cook’s independence and has determined that FW Cook does not have any conflict of interest. Our Nominating and Governance Committee also engages FW Cook to assist it in evaluating the compensation of our independent directors.

•We established anOur Executive Committee to exerciseis tasked with exercising certain authority of our Board in the management of company affairs between regularly scheduled meetings of our Board when it is determined that a specified matter should not be postponed to the next scheduled meeting of our Board. Our Executive Committee did not meet in 2022.2023.

•We have adopted a Global Code of Ethics that sets forth basic principles to guide our day-to-day activities. The Global Code of Ethics addresses, among other things, conflicts of interest, corporate opportunities,gifts and entertainment, outside business activities, confidentiality, fair dealing, protectioncompetition and proper use of company assets,anti-trust compliance, political and charitable contributions, compliance with laws and regulations, including with respect to insider trading, laws,money laundering and sanctions, and reporting illegal or unethical behavior. The full text of our Global Code of Ethics is available on our website at www.assuredguaranty.com/governance.

•In addition to AGL’s quarterly Board meetings, our Board has an annual business review meeting to assess specific areas of our Company’s operations and to learn about general trends affecting the financial guaranty and asset management industries. We also provide our directors with the opportunity to attend continuing education programs.

•We established anOur Environmental and Social Responsibility Committee in May 2019, which began meeting in August 2019. Prior to the establishmentfocuses on environmental risks, particularly climate change related risks, and aspects of the Environmentalhuman capital management, such as diversity and Social Responsibility Committee, our Nominatinginclusion, training and Governance Committee was responsible for many such matters.development, and employee engagement.

•We adopted an Environmental Policy, and a Statement on Climate Change in February 2019 and, in February 2020, we adopted a Human Rights Statement. In February 2021, we adoptedStatement, a Diversity and Inclusion Policy. Since then, we have reviewedPolicy and updateda Human Rights Statement; these policies and statements articulate our approach to environmental stewardship and thesocial responsibility and guide our initiatives. Our Board reviews them annually and current versions are available on our website at www.assuredguaranty.com/governance.

HOW ARE DIRECTORS NOMINATED?

In accordance with its charter, our Nominating and Governance Committee identifies potential nominees for directors from various sources. Our Nominating and Governance Committee:

•Reviews the qualifications of potential nominees to determine whether they might be good candidates for Board of Directors membership

•Reviews the potential nominees’ judgment, experience, independence, understanding of our business or other related industries and such other factors as it determines are relevant in light of the needs of our Board of Directors and our Company

•Selects qualified candidates and reviews its recommendations with our Board of Directors, which will decide whether to nominate the person for election to our Board of Directors at an Annual General Meeting of Shareholders (which we refer to as an Annual General Meeting). Between Annual General Meetings, our Board, upon the recommendation of our Nominating and Governance Committee, can fill vacancies on our Board by appointing a director to serve until the next Annual General Meeting.

Our Nominating and Governance Committee has the authority to retain search firms to be used to identify director candidates and to approve the search firm’s fees and other retention terms. Our Nominating and Governance Committee may also retain other advisors.

We believe that diversity among members of our Board is an important consideration and is critical to our Board’s ability to perform its duties and various roles. Accordingly, in recommending nominees, our Board considers a wide range of individual perspectives in addition to diversity in professional experience and training. In 2021, our Board amended ourOur Corporate Governance Guidelines to specify that our Nominating and Governance Committee will include, and will direct any director search firm that may be retained to identify nominees for director to

5 Assured Guaranty 20232024 Proxy Statement

identify nominees for director, to include, highly qualified candidates who reflect a variety of backgrounds (including in respect of gender, race or ethnicity) in the pool of potential candidates being considered.

Our Corporate Governance Guidelines address diversity of experience, requiring our Nominating and Governance Committee to review annually the skills and attributes of Board members within the context of the current make-up of the full Board. The guidelines also provide that Board members should have individual backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve our governance and strategic needs. Our Nominating and Governance Committee will consider Board candidates on the basis of a range of criteria, including broad-based business knowledge and contacts, and skills in risk and management oversight, prominence and sound reputation in their fields as well as having a global business perspective and commitment to good corporate citizenship. Our Corporate Governance Guidelines specify that directors should represent all shareholders and not any special interest group or constituency. The guidelines additionally specify that directors should be able and prepared to provide wise and thoughtful counsel to top management on the full range of potential issues facing us. Directors must possess the highest personal and professional integrity. Directors must have the time necessary to fully meet their duty of due care to the shareholders and be willing to commit to service over the long term.

Our Nominating and Governance Committee annually reviews its own performance. In connection with such evaluation, our Nominating and Governance Committee assesses whether it effectively nominates candidates for director in accordance with the above described standards specified by the Corporate Governance Guidelines.

Our Board is currently composed of individuals from different disciplines, including accountants, lawyers, accountants and individuals who have industry, finance, executive and international experience, and is composed of both men and women of different races and ethnicities, and citizens of the United States, the United Kingdom and Japan. See each nominee’s biography appearing later in this proxy statement for a description of the specific experience that each such individual brings to our Board.

Our Nominating and Governance Committee will consider a shareholder’s recommendation for director but has no obligation to recommend such candidate for nomination by our Board of Directors. Assuming that appropriate biographical and background material is provided for candidates recommended by shareholders, our Nominating and Governance Committee will evaluate those candidates by following substantially the same process and applying substantially the same criteria as for candidates recommended by other sources. If a shareholder has a suggestion for a candidate for election, the shareholder should send it to: Secretary, Assured Guaranty Ltd., 30 Woodbourne Avenue, Hamilton HM 08, Bermuda. No person recommended by a shareholder will become a nominee for director and be included in a proxy statement unless our Nominating and Governance Committee recommends, and our Board approves, such person.

If a shareholder desires to nominate a person for election as director at an Annual General Meeting, that shareholder must comply with Article 14 of AGL’s Bye-Laws, which requires notice no later than 90 days prior to the anniversary date of the immediately preceding Annual General Meeting. This time period has passed with respect to the 20232024 Annual General Meeting. With respect to the 20242025 Annual General Meeting, AGL must receive such written notice on or prior to February 3, 2024.1, 2025. Such notice must describe the nomination in sufficient detail to be summarized on the agenda for the meeting and must set forth:

•the shareholder’s name as it appears in AGL’s books

•a representation that the shareholder is a record holder of AGL’s Common Shares and intends to appear in person or by proxy at the meeting to present such proposal

•the class and number of Common Shares beneficially owned by the shareholder

•the name and address of any person to be nominated

•a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons, naming such other person or persons, pursuant to which the nomination or nominations are to be made by the shareholder

•such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the SEC’s proxy regulations

•the consent of each nominee to serve as a director of AGL, if so elected

COMMITTEES OF THE BOARD

Our Board of Directors has established an Audit Committee, a Compensation Committee, an Environmental and Social Responsibility Committee, a Finance Committee, a Nominating and Governance Committee, a Risk Oversight Committee and an Executive Committee. All of our Board committees other than our Executive Committee are composed entirely of directors who are independent of our Company and management, as defined by the NYSE listing standards and as applied by our Board. Ms. McCloskey, who is currently a member of our EnvironmentalMr. Buhl, Mr. Kenny and Social Responsibility, Finance, and Risk Oversight Committees,Mr. Leathes will be retiring from our Board effective upon the election of our directors at our Annual General Meeting of Shareholders on May 3, 2023.2, 2024.

Assured Guaranty 20232024 Proxy Statement 6

| | | | | |

| The Audit Committee | Chair: Bonnie L. Howard / 4 meetings during 20222023 |

Other Audit Committee members: G. Lawrence Buhl, Thomas W. Jones, Lorin P.T. Radtke, Courtney C. Shea, and (beginning February 2024) Mark C. Batten |

Our Audit Committee provides oversight of the integrity of our Company’s financial statements and financial reporting process, our compliance with legal and regulatory requirements, the system of internal controls, the audit process, the performance of our internal audit program and the performance, qualification and independence of the independent auditor. Our Audit Committee is also responsible for the oversight of Company risks related to (i) financial reporting, accounting policies and reserving, (ii) legal, regulatory and compliance matters, (iii) cybersecurity risks related to our financial systems (as part of its oversight of the management of such risks, in coordination with our Risk Oversight Committee's supervision of our Company's information technology, which we refer to as IT, and security risk management programs), (iv) workouts, emerging events, and counterparties, and (v) business continuity planning.

Our Board has determined that each member of the Audit Committee satisfies the financial literacy requirements of the NYSE and is an audit committee expert as defined under Item 407(d) of the SEC’s Regulation S-K. For additional information about the qualifications of our Audit Committee members, see their respective biographies set forth in “Proposal No. 1: Election of Directors.”

| | | | | |

| The Compensation Committee | Chair: Thomas W. Jones / 5 meetings during 20222023 |

| Other Compensation Committee members: G. Lawrence Buhl, Bonnie L. Howard, Patrick W. Kenny, Yukiko Omura |

Our Compensation Committee has responsibility for evaluating the performance of our CEO, each of our other executive officers, and our other senior managers reporting directly to our CEO, all of whom together we refer to as our senior leadership team, and determining executive compensation in conjunction with the independent directors. Our Compensation Committee also works with our Nominating and Governance Committee and our CEO on succession planning. Our Compensation Committee is responsible for the oversight of Company risks related to people, succession planning and compensation.

Our Compensation Committee’s meetings included discussions with FW Cook to review executive compensation trends and comparison group compensation data and to evaluate the risk of our executive compensation program.

| | | | | |

| The Environmental and Social Responsibility Committee | Chair: Alan J. Kreczko / 4 meetings during 20222023 |

Other Environmental and Social Responsibility Committee members: Patrick W. Kenny, Simon W. Leathes, Michelle McCloskey, Yukiko Omura, Lorin P.T. Radtke |

Our Environmental and Social Responsibility Committee provides oversight and review of our Company’s significant strategies, policies and practices regarding environmental and social responsibility issues. Our Environmental and Social Responsibility Committee focuses on four principal subject areas: (i) environmental risks, including climate change related risks, opportunities, and stewardship; (ii) corporate social responsibility, including community engagement and corporate philanthropy; (iii) aspects of human capital management, including diversity and inclusion, training and development, and employee engagement; and (iv) related stakeholder engagement.

| | | | | |

| The Finance Committee | Yukiko Omura / 4 meetings during 20222023 |

Other Finance Committee members: Alan J. Kreczko, Simon W. Leathes, Michelle McCloskey, Lorin P.T. Radtke, Courtney C. Shea, and (beginning February 2024) Mark C. Batten |

Our Finance Committee of our Board of Directors oversees management’s investment of our Company’s investment portfolio, including in alternative investments, and is responsible for oversight of Company risks related to capital, liquidity, investments, financial market conditions, foreign currency, and rating agencies. Our Finance Committee also oversees, and makes recommendations to our Board with respect to, our capital structure, dividends, financing arrangements, investment guidelines, potential alternative investments and any corporate development activities.

| | | | | |

| The Nominating and Governance Committee | Chair: Francisco L. Borges / 4 meetings during 20222023 |

| Other Nominating and Governance Committee members: G. Lawrence Buhl, Bonnie L. Howard, Thomas W. Jones, Patrick W. Kenny, Alan J. Kreczko |

The responsibilities of our Nominating and Governance Committee include identifying individuals qualified to become Board members, recommending director nominees to our Board and developing and recommending corporate governance guidelines, as well as the oversight of Company risks related to board qualification, corporate structure, governance, regulatory compliance and people. Our Nominating and Governance Committee also has responsibility to review and make recommendations to the full Board regarding director compensation. In addition to general corporate governance matters, our Nominating and Governance Committee assists our Board and our Board committees in their self-evaluations.

7 Assured Guaranty 2024 Proxy Statement

| | | | | |

| The Risk Oversight Committee | Chair: Simon W. LeathesLorin P.T. Radtke / 4 meetings during 20222023 |

Other Risk Oversight Committee members: Michelle McCloskey, Yukiko Omura, Lorin P.T. Radtke,Alan J. Kreczko, Simon W. Leathes, Courtney C. Shea, and (beginning February 2024) Mark C. Batten |

Our Risk Oversight Committee oversees management’s establishment and implementation of standards, controls, limits, guidelines and policies relating to risk appetite, risk assessment and enterprise risk management. Our Risk Oversight Committee focuses on the underwriting, surveillance and workout of credit risks as well as the assessment, management and oversight of other Company

7 Assured Guaranty 2023 Proxy Statement

enterprise risks across our insurance and asset management segments and corporate division, including, but not limited to, financial, legal, operational (including IT, cybersecurity, data privacy, and outsourcing and vendor management) and other risks concerning our Company’s governance, reputation and ethical standards.

| | | | | |

| The Executive Committee | Chair: Francisco L. Borges / No meetings during 20222023 |

| Other Executive Committee members: Dominic J. Frederico, Patrick W. Kenny, Simon W. Leathes, Yukiko Omura |

Our Executive Committee was established to have, and to exercise, certain of the powers and authority of our Board in the management of the business and affairs of our Company between regularly scheduled meetings of our Board when, in the opinion of a quorum of the Executive Committee, a matter should not be postponed to the next scheduled meeting of our Board. Our Executive Committee’s authority to act is limited by our Company’s Bye-Laws, rules of the NYSE and applicable law and regulation and the Committee’s charter.

HOW ARE DIRECTORS COMPENSATED?

Our independent directors receive an annual retainerfee of $265,000 per year. We pay $145,000 of the retainerfee in restricted stockshares and $120,000 of the retainerfee in cash. A director also may elect to receive any or all of the cash portion of their annual retainerfee (plus the additional cash amounts described below) in restricted stock.shares.

The restricted stock vestsshares vest on the day immediately prior to the next Annual General Meeting following the grant of the stock.shares. However, if, prior to such vesting date, either (i) a change in control (as defined in the Assured Guaranty Ltd. 2004 Long-Term Incentive Plan, as amended) of Assured Guaranty Ltd. occurs before the director terminates service on our Board or (ii) the director terminates service on our Board as a result of such director’s death or disability, then the restricted stockshares will vest on the date of such change in control or the date of the director’s termination of service, whichever is applicable. Grants of restricted stockshares receive cash dividends and have voting rights; the cash dividends accrue during the vesting period and are paid upon vesting.rights.

Our share ownership guidelines require that, before being permitted to dispose of any shares acquired as compensation from our Company, each independent director own Common Shares with a market value of at least $600,000, which amount is five times the maximum cash portion of the annual director retainerfee (exclusive of committee fees). Once a director has reached the share ownership guideline, for so long as he or she serves on our Board, such director may not dispose of any Common Shares if such disposition would cause the director to be below the share ownership guideline. Common Shares that had been restricted but subsequently vested, in addition to purchased Common Shares, count toward the share ownership guideline. Mr. Batten, who joined our Board in February 2024, along with Mr. Radtke and Ms. Shea, who each joined our Board in May 2021, are accumulating Common Shares toward their ownership goals, while all our other independent director-nominees, who have served on our Board longer, meet their share ownership guidelines.

In addition to the annual retainerfee described above:

•The non-executive Chairchair of our Board receives ana $225,000 annual retainer of $225,000fee in recognition of the strategic role he plays and the time commitment involved. The Chairchair of our Board has elected not to receive any fees for serving as a member or chair of a boardBoard committee.

•The chair of each committee of our Boardthe Environmental and Social Responsibility Committee, Finance Committee, Nominating and Governance Committee, and Risk Oversight Committee receives a $30,000 annual fee.

•The chair of each of the Audit Committee and the Compensation Committee receives a $40,000 annual fee.

•Neither the chair nor the other thanmembers of the Executive Committee receives an additional $30,000 annual retainer.fee.

•Members, other than the chair, of the committee, of each other committee of our Board other than the Executive Committee receive an additionala $15,000 annual retainer.fee.

The Company generally will not pay a fee for attendance atattending Board or committee meetings, although the Chairchair of our Board has the discretion to pay attendance fees of $2,000 for extraordinary or special meetings. There were no extraordinary meetings of our Board in 2022.2023. We do not pay a fee for being a member, or attending meetings of the Executive Committee.

Assured Guaranty 2024 Proxy Statement 8

In 2021,2023, our Nominating and Governance Committee engaged FW Cook to conduct a comprehensive review and assessment of our independent director compensation program. FW Cook reviews this program periodically. FW Cook evaluated our director compensation by comparing it against the compensation awarded to directors of companies in our executive compensation comparison group as constituted by FW Cook in 2020,2022, and which we refer to as the 20202022 executive compensation comparison group. (Our current executive compensation comparison group, and how it changed from our 2022 executive compensation comparison group, is described under “Compensation Governance — Executive Compensation Comparison Group” below). FW Cook also looked at a broader market segment using data from FW Cook’s 20202022 Director Compensation Report, the most recent year for which such information was available. FW Cook found that the structure of our director compensation program was generally consistent with peer 20202022 executive compensation comparison group policy and best practice design as recognized by the proxy advisory firms and investors, noting:

•the absence of meeting fees to simplify program administration and avoid the implication that there is additional pay for meeting attendance, which is an expected part of Board service

•the use of committee member retainersfees to differentiate compensation among directors based on workload

•the vesting of annual restricted stockshare awards over a one-year period, which protects against the possibility of director entrenchment

Assured Guaranty 2023 Proxy Statement 8

•the payment of additional retainersfees to our Board and committee leadership to recognize the additional responsibilities and time commitment associated with these roles

•our limited benefits (we provide a Company match of up to $15,000 per director for contributions to charitable organizations of the director’s choice)

•a meaningful and robust stockshare ownership guideline

No changes were madeFW Cook also discussed with the Nominating and Governance Committee the time commitments and responsibilities of the Board's committee chairs and, based on that feedback, recommended $10,000 increases to the annual fee for the chairs of our independentAudit Committee and our Compensation Committee, to $40,000, beginning with the 2023-2024 period. All other non-executive director compensation program in 2022, 2021, or 2020.has remained unchanged since the 2019-2020 period.

FW Cook found in 2021 thatOur Nominating and Governance Committee believes the aggregate cost of our independent director compensation program approximatedis appropriate due to the 75th percentilecomplexity of our 2020 executive compensation comparison group. FW Cook also found that, before consideringbusiness model, the instances wheretime our directors have chosenspend keeping themselves up-to-date on our Company by discussing matters with our CEO and other key executives and our principal external advisors, by reading the reports and other materials that we send them regularly, and the need for our directors to receive a portion of their cash compensation in our common shares, our totaltravel to the U.K. four times per director compensation has a somewhat heavier weighting on cash compensation than that of our 2020 executive compensation comparison group.year for regularly scheduled meetings, and sometimes more often if necessary.

DIRECTOR COMPENSATION

The following table sets forth our 20222023 independent director compensation, including the compensation for the directors’ committee assignments as of such date.

| | Name | Name | Fees Earned or

Paid in Cash | Stock Awards(1) | All Other Compensation(2) | Total | Name | Fees Earned or

Paid in Cash | Share Awards(1) | All Other Compensation(2) | Total |

Mark C. Batten (3) | | Mark C. Batten (3) | — | — |

Francisco L. Borges(3)(4) | Francisco L. Borges(3)(4) | $345,000 | $145,000 | $21,535 | $511,535 | Francisco L. Borges(3)(4) | $345,000 | $145,000 | $16,406 | $506,406 |

| G. Lawrence Buhl | G. Lawrence Buhl | $165,000 | $145,000 | $16,573 | $326,573 | G. Lawrence Buhl | $165,000 | $145,000 | $26,655 | $336,655 |

| Bonnie L. Howard | Bonnie L. Howard | $180,000 | $145,000 | $16,573 | $341,573 | Bonnie L. Howard | $190,000 | $145,000 | $51,655 | $386,655 |

| Thomas W. Jones | Thomas W. Jones | $180,000 | $145,000 | $16,573 | $341,573 | Thomas W. Jones | $190,000 | $145,000 | $30,897 | $365,897 |

Patrick W. Kenny(4)(5) | Patrick W. Kenny(4)(5) | $165,000 | $145,000 | $30,193 | $340,193 | Patrick W. Kenny(4)(5) | $165,000 | $145,000 | $21,386 | $331,386 |

Alan J. Kreczko(5)(6) | Alan J. Kreczko(5)(6) | $180,000 | $145,000 | $16,573 | $341,573 | Alan J. Kreczko(5)(6) | $180,000 | $145,000 | $34,369 | $359,369 |

Simon W. Leathes(6)(7) | Simon W. Leathes(6)(7) | $180,000 | $145,000 | $11,739 | $336,739 | Simon W. Leathes(6)(7) | $165,000 | $145,000 | — | $310,000 |

Michelle McCloskey | Michelle McCloskey | $165,000 | $145,000 | $2,420 | $312,420 | Michelle McCloskey | — | $2,546 | $2,546 |

Michael T. O'Kane(7) | — | $12,420 | $12,420 |

| Yukiko Omura | Yukiko Omura | $180,000 | $145,000 | — | $325,000 | Yukiko Omura | $180,000 | $145,000 | — | $325,000 |

| Lorin P.T. Radtke | Lorin P.T. Radtke | $165,000 | $145,000 | $17,420 | $327,420 | Lorin P.T. Radtke | $180,000 | $145,000 | $27,546 | $352,546 |

| Courtney C. Shea | Courtney C. Shea | $165,000 | $145,000 | $17,420 | $327,420 | Courtney C. Shea | $165,000 | $145,000 | $27,546 | $337,546 |

(1) Represents grant date fair value, rounded to the nearest $1,000.

(2) Other compensation consists of matching gift donations to eligible charities paid in 20222023 or paid in early 20232024 for donations made in 2022,2023 (in 2023, our Company offered to match donations of up to $25,000, plus a special match of up to $25,000 for donations to support humanitarian aid), reimbursement of business-related spousal travel paid in 20222023, and U.K. personal tax return preparation fees paid in 20222023 or paid in early 20232024 for services performed in 2022. After2023.

9 Assured Guaranty 2024 Proxy Statement

(3) Mr. O'Kane's retirement from our Board,Batten became a director of AGL in recognitionFebruary 2024. He was not compensated in 2023 as an AGL director; however, for Mr. Batten's term as an AGL director ending at the 2024 Annual General Meeting, he received one-half of his service, our Company gifted $2,500the annual director fee and one-half of the committee member fees payable to AGL's independent directors, consisting of cash and restricted shares (the number of shares granted being calculated by dividing a value by the average closing price on the NYSE of a Common Share over the 40 consecutive trading days ending on February 21, 2024, the date of grant). In addition, Mr. O'Kane and madeBatten serves as a donation of $2,500 to an eligible charity in his honor; these amounts are included in All Other Compensation. After Mr. Leathes' retirement from the boardnon-executive director of Assured Guaranty (UK)UK Limited, for which he received annual director and committee fees of £126,250 in recognition2023 (which was approximately $160,729 as of his service, our Company made a donation of £4,000 to an eligible charity in his honor, which amount is included in All Other Compensation.December 31, 2023).

(3)(4) Mr. Borges agreed to forgo an additional fee as the Chair of our Nominating and Governance Committee due to the substantial overlap between that position and his position as the Chair of the Board. Mr. Borges also does substantial work on executive compensation in conjunction with our Compensation Committee, for which he does not receive a fee. Mr. Borges elected to receive the entire cash component of his compensation as restricted stock.shares.

(4)(5) Mr. Kenny elected to receive $15,000$20,000 of the cash component of his compensation as restricted stockshares and the remaining $150,000$145,000 in cash.

(5)(6) Mr. Kreczko elected to receive the entire cash component of his compensation as restricted stock.shares.

(6)(7) Mr. Leathes elected to receive $30,000$15,000 of the cash component of his compensation as restricted stockshares and the remaining $150,000 in cash.

(7) Mr. O'Kane(8) Ms. McCloskey retired from our Board in May 20222023 and did not receive any fees or stockshare awards in May 2022.2023. Her director compensation paid in May 2022 included $82,500 in cash and $72,500 of Common Shares for a total of $155,000 related to fiscal year 2023.

9 Assured Guaranty 2023 Proxy Statement

The following table shows information related to independent director equity awards outstanding on December 31, 2022: 2023:

| | | | | |

| Name | Unvested Restricted StockShares(1) |

| Francisco L. Borges | 8,2399,376 |

| G. Lawrence Buhl | 2,4382,775 |

| Bonnie L. Howard | 2,4382,775 |

| Thomas W. Jones | 2,4382,775 |

| Patrick W. Kenny | 2,6903,157 |

| Alan J. Kreczko | 5,4656,219 |

| Simon W. Leathes | 2,943 |

Michelle McCloskey | 2,4383,062 |

| Yukiko Omura | 2,4382,775 |

| Lorin P.T. Radtke | 2,4382,775 |

| Courtney C. Shea | 2,4382,775 |

(1) Vests one day prior to the 20232024 Annual General Meeting.

Assured Guaranty 20232024 Proxy Statement 10

WHAT IS OUR BOARD LEADERSHIP STRUCTURE?

Our current Chair of the Board is Francisco L. Borges. The position of CEO is held by Dominic J. Frederico.

While our Board has no fixed policy with respect to combining or separating the offices of Chair of the Board and CEO, those two positions have been held by separate individuals since our 2004 initial public offering. We believe this is the appropriate leadership structure for us at this time. Mr. Borges and Mr. Frederico have had an excellent working relationship, which has continued to permit Mr. Frederico to focus on running our business and Mr. Borges to focus on Board matters, including oversight of our management. Mr. Borges and Mr. Frederico collaborate on setting agendas for Board meetings to be sure that our Board discusses the topics necessary for its oversight of the management and affairs of our Company. As Chair of the Board, Mr. Borges sets the final Board agenda and chairs Board meetings, including executive sessions at which neither our CEO nor any other member of management is present. The Chair of the Board also chairs our Annual General Meetings.

HOW DOES THE BOARD OVERSEE RISK?

Our Board’s role in risk oversight is consistent with our leadership structure, with our CEO and other members of our senior leadership team having responsibility for assessing and managing risk exposure and our Board and its committees providing oversight in connection with these activities. Our Company’s policies and procedures relating to risk assessment and risk management are overseen by our Board. Our Board employs an enterprise-wide approach to risk management that supports our Company’s business plans at a reasonable level of risk. Risk assessment and risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for that company. Our Board annually approves our business plan, factoring risk management into account, and also approves our Company’s risk appetite statement, which articulates our Company’s tolerance for risk and describes the general types of risk that our Company accepts or attempts to avoid. The involvement of our Board in setting our business strategy is a key part of its assessment of management’s risk tolerance and also a determination of what constitutes an appropriate level of risk for us.

While our Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of our Board also have responsibility for risk assessment and risk management. As discussed under “Committees of the Board,” our Board has created a Risk Oversight Committee that oversees the standards, controls, limits, underwriting guidelines and policies that our Company establishes and implements in respect of credit underwriting and risk management. It focuses on management’s assessment and management of both (i) credit risks and (ii) other enterprise risks, including, but not limited to, market, financial, legal and operational risks (including cybersecurity and data privacy risks), climate, and risks relating to our reputation and ethical standards. Our Risk Oversight Committee and Board pay particular attention to credit risks we assume when we issuetake on financial guaranties or engage in strategic transactionsguaranty exposure and to risks related to our participation in the asset management segment.business. In addition, the Audit Committee of our Board of Directors is responsible for, among other matters, reviewing policies and processes related to the evaluation ofcovering risk assessment and risk management includingfor our major financial risk exposuresreporting and the steps management has taken to monitor and control such exposures.controls. It also oversees cybersecurity risks related to our financial systems as part of its oversight of the management of such risks, in coordination with the Risk Oversight Committee's supervision of our Company's technology and security risk management programs, and reviews our Company's compliance with legal and regulatory requirements. The Finance Committee of our Board of Directors oversees the investmentallocation and performance of our Company’s investment portfolio (including in respect of alternative investments) as well as the performance of our Company's investment in Sound Point, and our Company’s capital structure, financing arrangements, and rating agency matters, and any corporate development activities in support of our Company’s financial plan.matters. The Nominating and Governance Committee of our Board of Directors oversees risk at our Company by developing appropriate corporate governance guidelines and identifying qualified individuals to become board members. The Environmental and Social Responsibility Committee oversees risks related to the environment, sustainabilityour Company's environmental risk management and stewardship program (including climate change related risks that have a material impact on our Company) and social responsibility (including human capital management strategy and diversity and inclusion initiatives), while each of our other Board committees have responsibility for risk assessment of such risks to the extent within their purview.

As part of its oversight of executive compensation, our Compensation Committee reviews compensation risk. Our Compensation Committee oversaw the performance of a risk assessment of our employee compensation program to determine whether any of the risks arising from our compensation program are reasonably likely to have a material adverse effect on us. Since January 2011, our Compensation Committee has retained FW Cook to perform an annual review of our compensation program and identify areas of risk and the extent of such risk. Our Compensation Committee directs that our Chief Risk Officer work with FW Cook to perform such risk assessment and to be sure that compensation risk is included in our enterprise risk management system. In conducting this annual review, from time-to-time, most recently in February 2018,2024, FW Cook performs a comprehensive systemic, qualitative assessment of all of our incentive compensation programs and reviews its findings with our Chief Risk Officer for completeness and accuracy. FW Cook seeks to identify any general areas of risk or potential for unintended consequences that exist in the design of our compensation programs, as well as mitigating features, and to evaluate our incentive plans relative to our enterprise risks to identify potential areas of concern, if any.

11 Assured Guaranty 2024 Proxy Statement

As part of its February 2024 comprehensive review, FW Cook updates its compensation risk assessment annually, and did so most recently in February 2023, taking into accountconsidered the changes our Compensation Committee made in connection with its considerationthe past year, including the removal of growth in third party assets under management from our annual incentive compensationprogram in 2023 following the contribution of substantially all our asset management business to Sound Point for an approximately 30% interest in the 2022 performance year, which changes included amendmentscombined entity, and updates to our Executive Recoupment Policy to, among other things, expand the circumstances that trigger recoupment pursuant to the performance period of our Relative TSR performance restricted share units and

11 Assured Guaranty 2023 Proxy Statement

implementation of compensation arrangements for certain teams at Assured Investment Management, which we refer to as AssuredIM.policy. FW Cook concluded that our incentive plans are well-aligned with sound compensation design principles and do not encourage behaviors that would likely create material adverse risk for our Company. Our Chief Risk Officer reviewed their findings and agreed with their conclusion. Based on this update,comprehensive review, our Compensation Committee continued to find that there is an appropriate balance between the risks inherent in our business and our compensation program.

BOARD OVERSIGHT OF CYBERSECURITY

The security of our products, services and corporate network is a key priority both for the growth of our business and our responsibilities as the leading financial guaranty insurance company. We have taken a risk-based approach to cybersecurity and have adopted a Cybersecurity Policy and implemented its procedures throughout our operations.

To that end, we have developed a cybersecurity governance structure. Our Board of Directors, some of whose members have broad-based skills in risk management oversight and/or cybersecurity oversight certifications, assumes overall responsibility for overseeing our Company’s establishment and operation of a cybersecurity program and our management of cybersecurity risk. In 2023, our Chief Technology Officer and Chief Information Security Officer briefed our Board on the positive results of our annual penetration test, which simulated a targeted cyber attack against our Company through network penetration, phishing, and physical intrusion. Our Board also received a comprehensive briefing by external advisors on cybersecurity and board governance, including cybersecurity threat trends, incident response responsibilities, and relevant case studies, among other related topics. Our Chief Technology Officer and Chief Information Security Officer also briefed the Audit and Risk Oversight Committees on our cybersecurity program and cyber-threat landscape. Our Board delegates certain cybersecurity oversight responsibilities to the Risk Oversight Committee, which oversees enterprise risk, vendor management, and information technology risks, and to the Audit Committee, whose oversight responsibility includes cybersecurity risks, data privacy, and risk management related to our financial systems. The Risk Oversight Committee has specific responsibility for overseeing information technology processes and controls, including for cybersecurity, compliance with related policies, and the process to monitor risks we face arising from changing technology trends, and coordinates with the Audit Committee, as needed.

We maintain a robust Information Security Policy and Standards that details how material risks from cybersecurity threats are assessed, identified and managed. Our Chief Technology Officer oversees a process designed to remediate risks according to their criticality and presents to the Risk Oversight and Audit Committees and management at least semi-annually. Our Chief Information Security Officer also presents to the Board and the Risk Oversight and Audit Committees on cybersecurity and data privacy matters at least annually.

Awareness and alertness are important components to our cybersecurity program; upon onboarding and annually thereafter, our directors and employees are required to take cybersecurity training and we conduct regular exercises to educate employees about best practices and help them identify and avoid potential threats. We engage third-party consultants to conduct periodic penetration testing designed to identify potential security vulnerabilities. Our internal audit function, which has been outsourced to an international accounting firm, conducts periodic audits of cybersecurity and reports on such matters to the Audit Committee. We take measures designed to mitigate risks associated with third-party vendors that have access to confidential information or provide business critical functions.

COMPENSATION COMMITTEE INTERLOCKING AND INSIDER PARTICIPATION

Our Compensation Committee of our Board of Directors has responsibility for determining the compensation of our executive officers. None of the members of our Compensation Committee is a current or former officer or employee of our Company. No executive officer of our Company serves on the compensation committee of any company that employs any member of our Compensation Committee.

WHAT IS OUR RELATED PERSON TRANSACTIONS APPROVAL POLICY AND WHAT PROCEDURES DO WE USE TO IMPLEMENT IT?

Through our committee charters, we have established review and approval policies for transactions involving our Company and related persons, with our Nominating and Governance Committee taking the primary approval responsibility for transactions with our executive officers and directors and our Audit Committee taking the primary approval responsibility for transactions with 5% shareholders. No member of these committees who has an interest in a transaction being reviewed is allowed to participate in any decision regarding any such transaction.

Assured Guaranty 2024 Proxy Statement 12

Our Nominating and Governance Committee charter requires our Nominating and Governance Committeethe committee to review and approve or disapprove in advance all proposed transactions with executive officers and directors that, if entered into, would be required to be disclosed pursuant to Item 404 of Regulation S-K, the SEC provision whichthat requires disclosure of any related person transaction with our Company that exceeds $120,000 per fiscal year. Our Nominating and Governance Committee must also review reports, which our General Counsel provides periodically, and not less often than annually, regarding transactions with executive officers and directors that have resulted, or could result, in such expenditures even if they are not required to be disclosed pursuant to Item 404 of

Regulation S-K.

Our Audit Committee charter requires our Audit Committeethe committee to review and approve or disapprove in advance all proposed transactions, prior to such transactions with any person owning more than 5% of any class of our voting securities that, if entered into, would be required to be disclosed pursuant to Item 404 of Regulation S-K. In addition, ourOur Audit Committee charter requires our Audit Committee tomust also review reports, regarding such transactions, which our General Counsel provides to our Audit Committee periodically, and not less often than annually, regarding transactions with any persons owning more than 5% of any class of theour voting securities of AGL that have resulted, or could result, in expenditures even if they are not required to be disclosed pursuant to Item 404 of Regulation S-K.

Our General Counsel identifies related person transactions requiring committee review pursuant to our committee charters from transactions that are:

•disclosed in director and officer questionnaires (which must also be completed by nominees for director) or in certifications of Global Code of Ethics compliance

•reported directly by the related person or by another employee of our Company

•identified by our vendor management procedures and matching gift procedures based on comparison of vendors and matching gift recipients against a list of directors, executive officers and known 5% shareholders and certain of their related persons

WHAT RELATED PERSON TRANSACTIONS DO WE HAVE?

From time to time, institutional investors, such as large investment management firms, mutual fund management organizations and other financial organizations become beneficial owners (through aggregation of holdings of their affiliates) of 5% or more of a class of our voting securities and, as a result, are considered “related persons” under the SEC’s rules. These organizations may provide services to us. In 2022,2023, the following transactions occurred with investors who reported beneficial ownership of 5% or more of our voting securities.

As indicated in “Which Shareholders Own More Than 5% of Our Common Shares,” Wellington Management Group LLP and its affiliates, which we refer to as Wellington Management, and BlackRock, Inc. and its affiliates, which we refer to as BlackRock, own approximately 9.09%9.28% and 13.82%12.70% of our Common Shares outstanding, respectively, as of March 10, 20238, 2024 (the record date for our Annual General Meeting), based on the amount of Common Shares they reported in their Schedule 13G filings as of the date set forth in such filing, and on the amount of our Common Shares outstanding as of the record date. We appointed Wellington Management as an investment manager to manage certain of our investment accounts prior to it reaching such ownership thresholds. As of

Assured Guaranty 2023 Proxy Statement 12

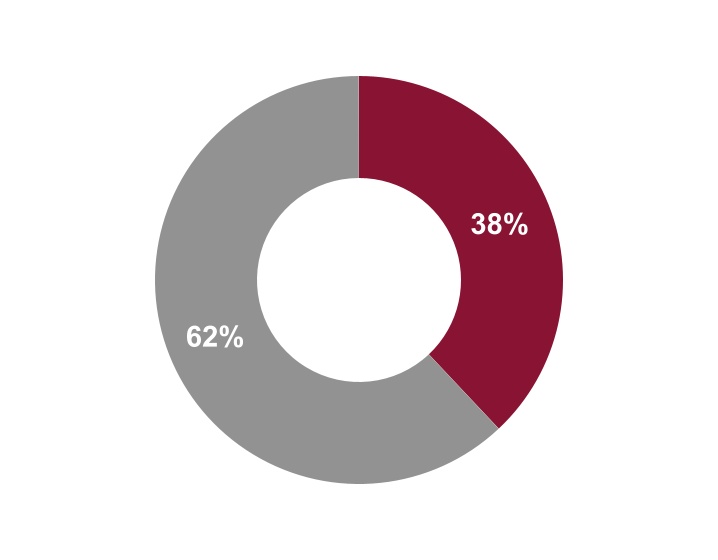

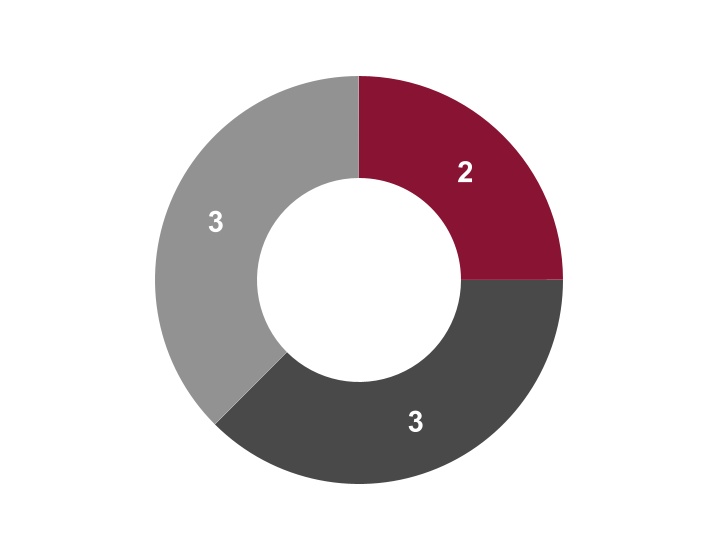

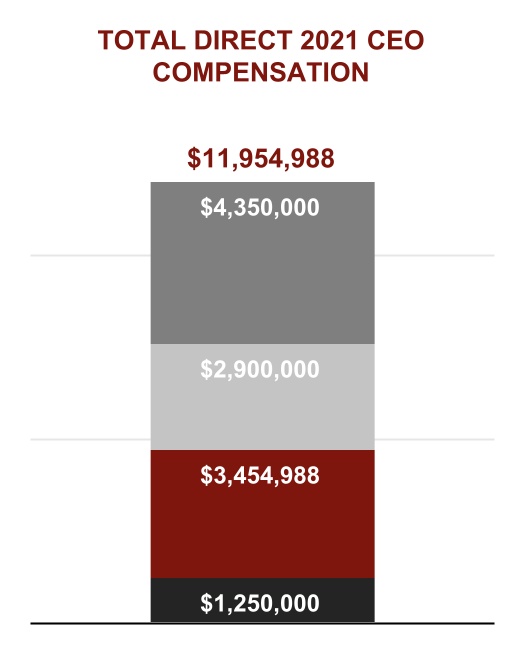

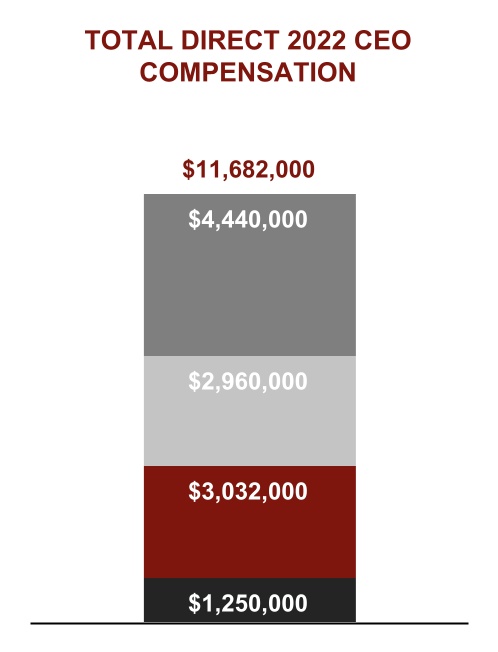

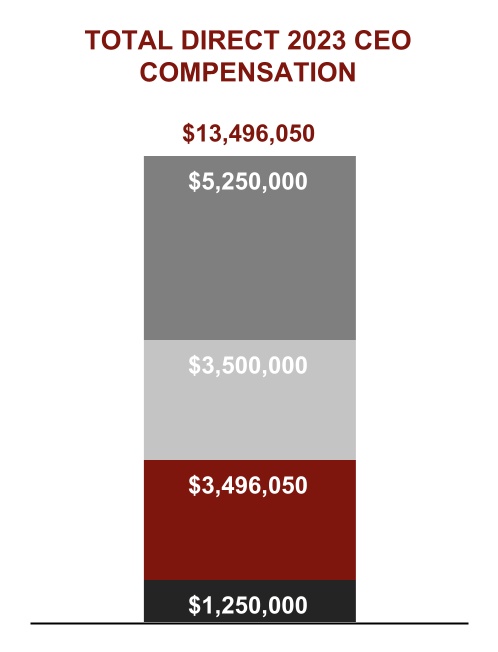

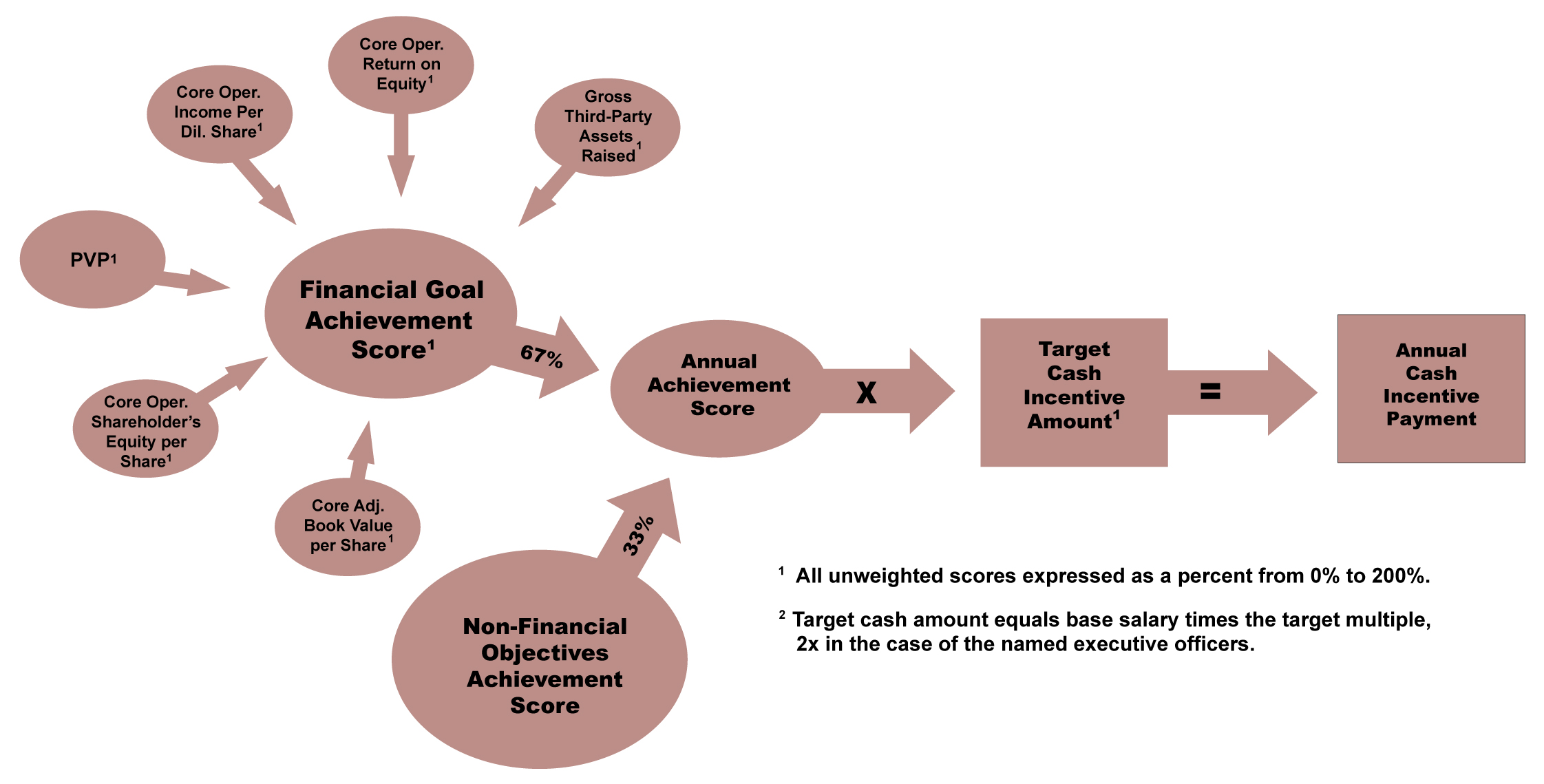

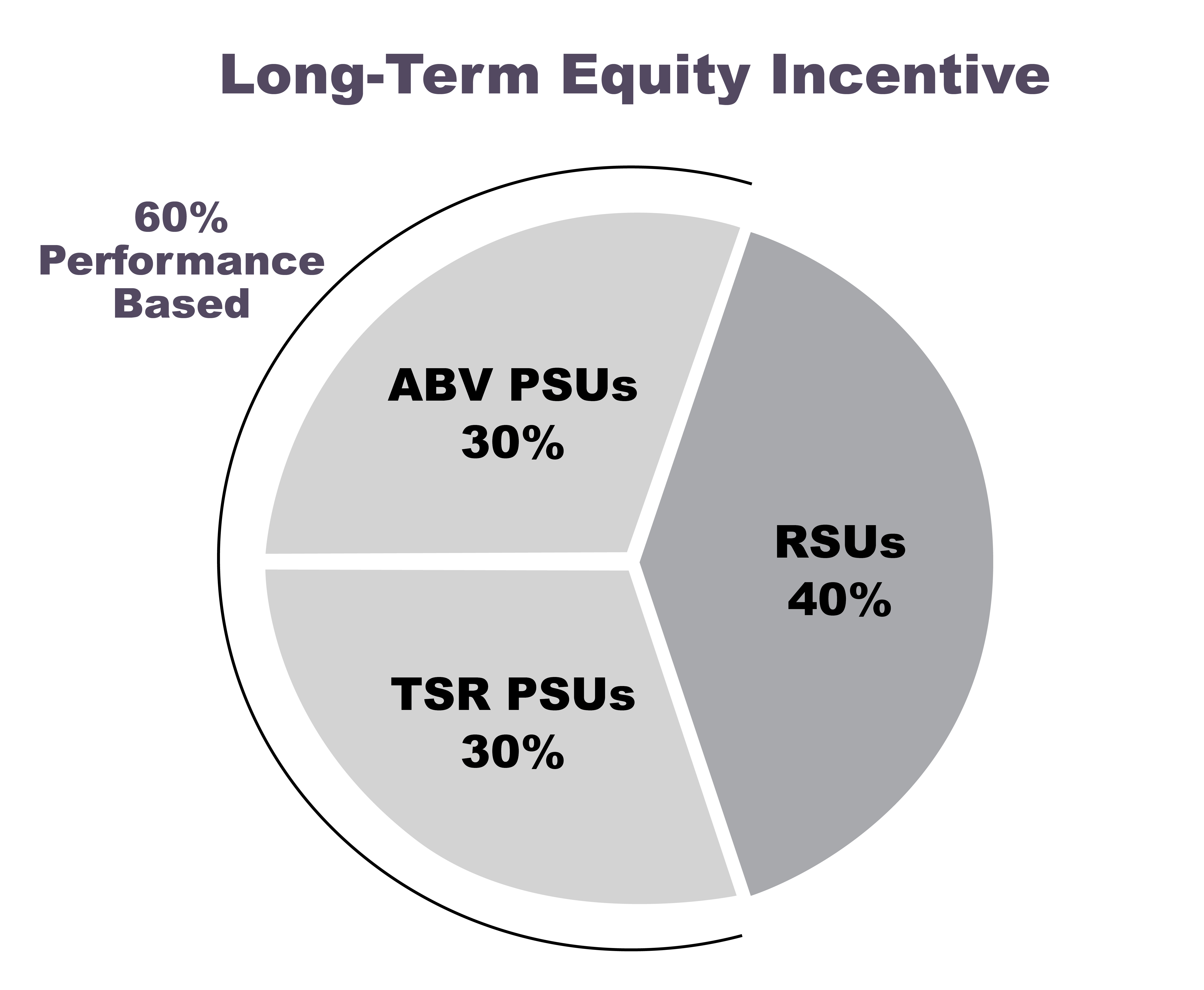

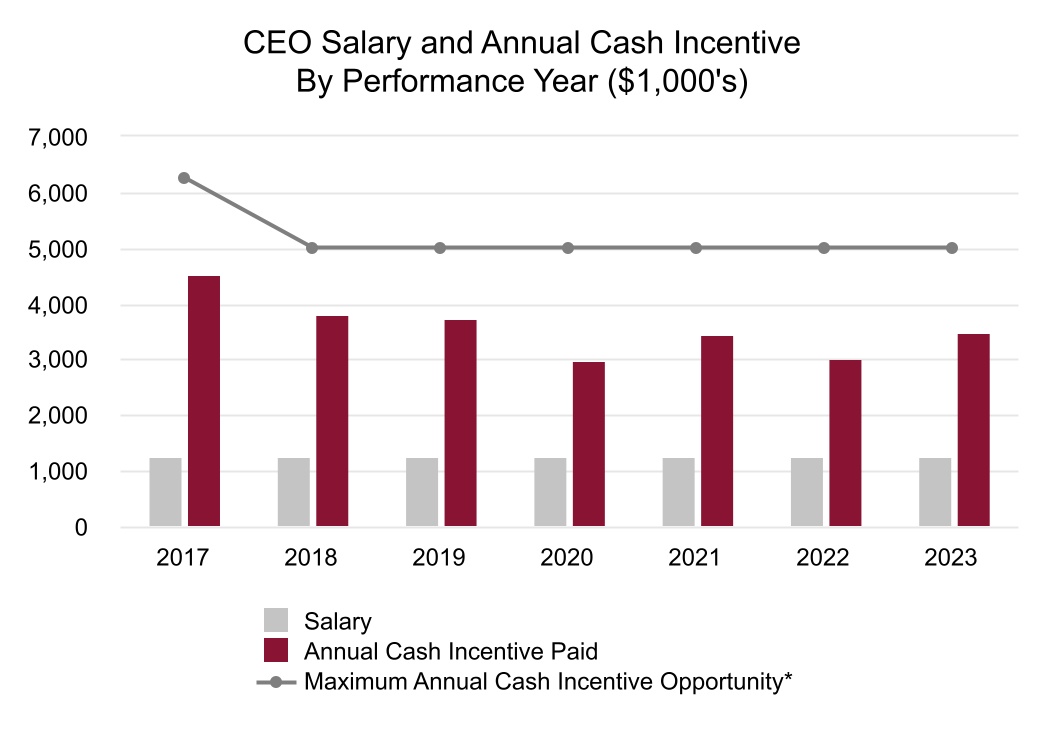

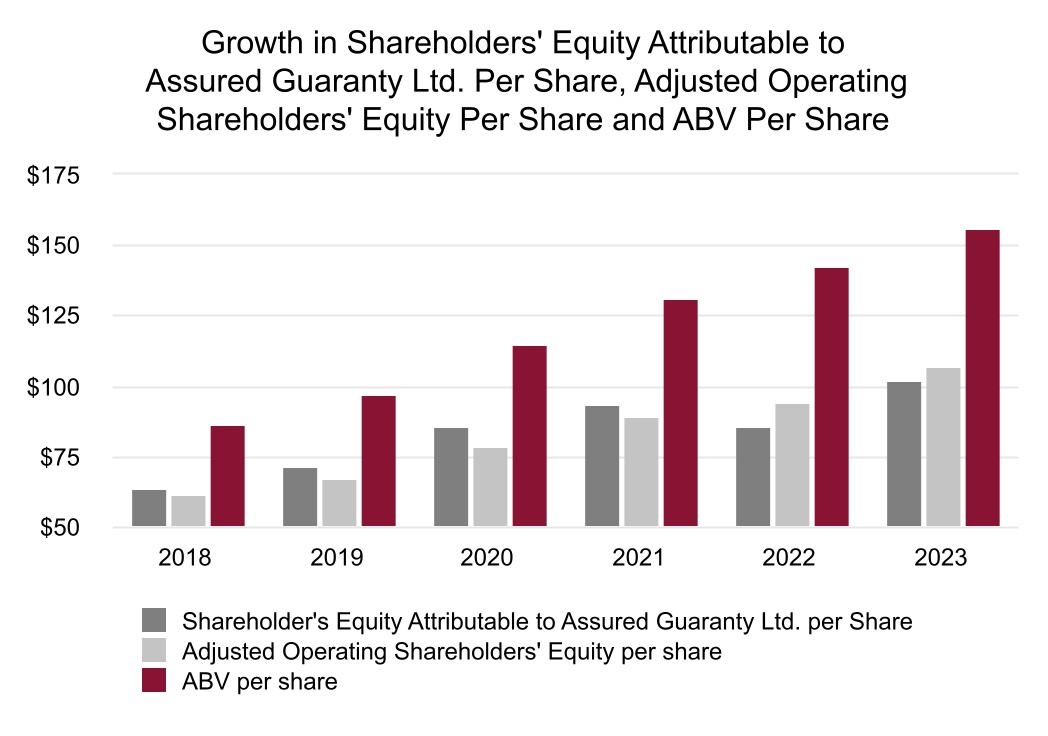

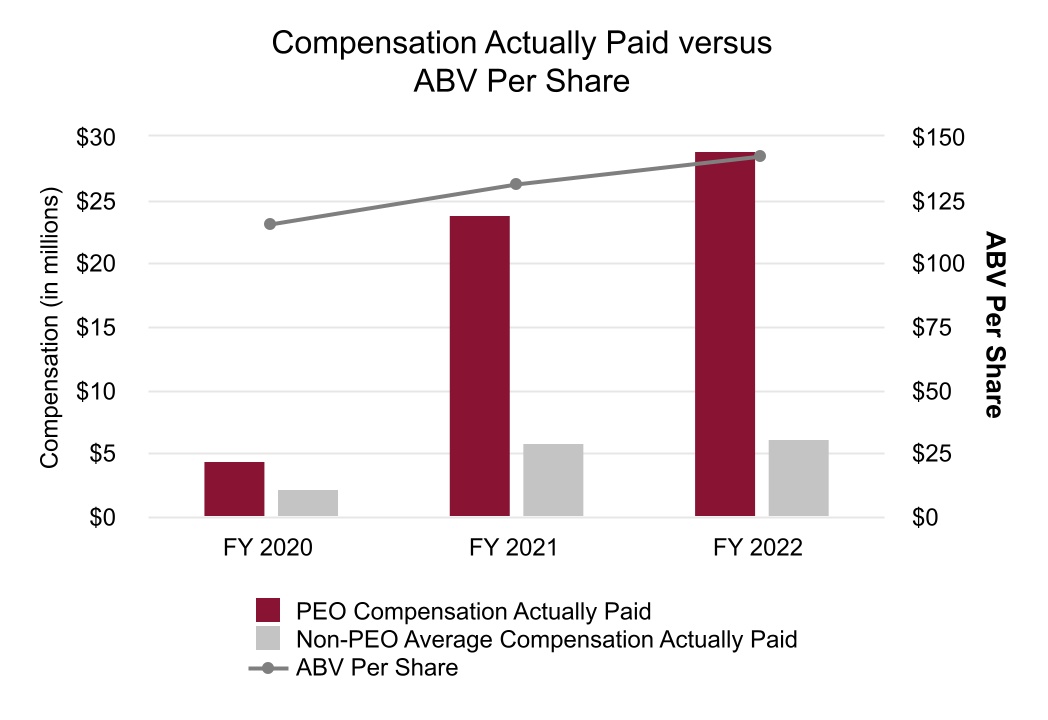

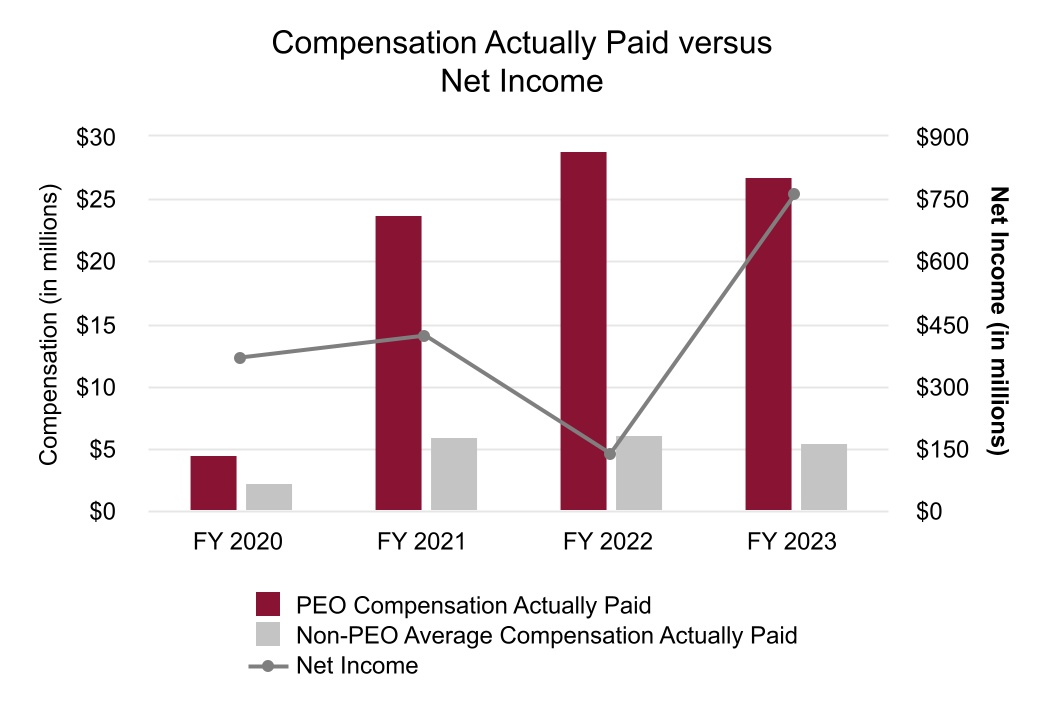

December 31, 2022,2023, Wellington Management managed approximately $2.2$2.1 billion of our investment assets, which is approximately 27%25% of our total fixed maturity and short-term investment portfolio. In 2022,2023, we incurred expenses of approximately $1.5$1.4 million related to our investment management agreement with Wellington Management. BlackRock supplies our investment reporting module, and in 20222023 we incurred expenses of approximately $460,600$500,000 with respect to that module.